Newsroom

- IR

FY2018 Full-year Financial Results

May 14, 2019 | Recruit Holdings Co., Ltd.

TOKYO, JAPAN (May 14, 2019) - Recruit Holdings Co., Ltd. ("Recruit Holdings" or the "Company") today announced financial results for the year ended March 31, 2019 (unaudited).

1. FY2018 Consolidated Financial Highlights

Consolidated revenue +6.3%, EBITDA +13.5%, Adjusted EPS +23.5%

-

Record-high revenue, EBITDA and Adjusted EPS

HR Technology segment continued its strong growth

-

Revenue increased +54.0% in US dollar terms, assuming accounting policy change was applied in FY2017*¹

(In billions of yen, unless otherwise stated)

| FY2017 | FY2018 | |||

|---|---|---|---|---|

| Actual | Forecasts | Actual | YoY | |

| Revenue | 2,173.3 | 2,302.0 | 2,310.7 | +6.3% |

| EBITDA | 258.4 | 285.0 | 293.2 | +13.5% |

| EBITDA margin | 11.9% | 12.4% | 12.7% | +0.8pt |

| Operating income | 191.7 | 210.0 | 223.0 | +16.3% |

| Profit attributable to owners of the parent | 151.6 | 153.0 | 174.2 | +14.9% |

| Adjusted profit | 144.9 | 170.0 | 178.9 | +23.5% |

| Adjusted EPS (yen) | 86.74 | 101.76 | 107.10 | +23.5% |

2. Q4 FY2018 and FY2018 Segment Highlights

HR Technology Segment:

-

Revenue for FY2018 increased by 49.6% yoy ( year on year) and by 54.0% yoy in US dollar terms, assuming application of an accounting policy change to the previous year on a pro forma basis*¹; the increase was mainly due to increased sponsored job advertising revenue from new and existing enterprise clients at Indeed and the contribution from Glassdoor, which was acquired during Q1 FY2018. Quarterly revenue increased by 45.4% yoy and by 46.3% yoy in US dollar terms, assuming the same accounting policy change to the previous year's quarter on a pro forma basis*¹.

-

EBITDA for FY2018 increased by 55.0% yoy, and quarterly EBITDA increased by 44.1% yoy.

-

Indeed attracts approximately 250 million monthly unique visitors*² and job seeker traffic continued to grow year on year during the quarter.

Indeed had approximately 8,900 employees located in 29 cities in 14 countries as of March 31, 2019.

-

Glassdoor attracts approximately 67 million monthly unique visitors*² and traffic grew double digits year on year during the quarter. Glassdoor had approximately 900 employees as of March 31, 2019.

Media & Solutions Segment:

-

Revenue for FY2018 increased by 6.1% yoy, primarily driven by increased revenue in the Housing and Real Estate and Beauty subsegments in Marketing Solutions and in the Recruiting in Japan subsegment in HR Solutions. Quarterly revenue increased by 6.9% yoy.

-

EBITDA for FY2018 increased by 10.4% yoy driven by higher profit in HR Solutions, particularly in Marketing Solutions. Quarterly EBITDA increased by 16.2% yoy.

-

Housing and Real Estate revenue for Q4 increased, primarily by improving the user experience on its online platform, attracting more individual users to the platform by various marketing efforts, and strengthening the relationship with enterprise clients by providing operational and management services.

-

Beauty revenue for Q4 continued to grow mainly by extending its reach to enterprise clients in non-urban areas and the outskirts of metropolitan areas.

-

Recruiting in Japan revenue for Q4 increased. The extremely tight labor market continued in Japan, and the subsegment focused on enhancing brand value, strengthening user attractiveness, and reinforcing its sales structure.

Staffing Segment:

-

Revenue for FY2018 and quarterly revenue decreased by 0.7% (Japan +6.5%, Overseas -5.3% (ex FX and IFRS15 impact: -1.6%)), and 4.9% (Japan +3.5%, Overseas -10.6% (ex FX and IFRS15 impact: -4.2%)) yoy respectively.

-

EBITDA for FY2018 and quarterly EBITDA for Q4 increased by 14.1% and 39.2% yoy respectively. EBITDA for Q4 FY2017 was impacted by the increased advertisement to grow the number of registered staff in Japan operations.

-

Japan operations revenue for Q4 increased as demand for agency workers continued to be strong, and placement revenue continued to increase as a result of revisions to Japanese laws, effective October 1, 2018, which encouraged enterprise clients to hire agency workers directly.

-

Overseas operations revenue for Q4 decreased mainly due to an uncertain outlook for the European economy, while it continued to focus on profitability improvement and simplifying the operational governance model in Europe.

Revenue

(In billions of yen)

| FY2017 | FY2018 | ||||

|---|---|---|---|---|---|

| Q4 | Q4 | YoY | Full Year | YoY | |

| Consolidated results | 556.4 | 580.3 | +4.3% | 2,310.7 | +6.3% |

| HR Technology | 61.9 | 90.0 | +45.4% | 326.9 | +49.6% |

| Reference: (In millions of US dollars) Revenue in US dollars with accounting policy change applied*¹ |

557 | 816 | +46.3% | 2,944 | +54.0% |

| Media & Solutions | 181.2 | 193.7 | +6.9% | 721.4 | +6.1% |

| Marketing Solutions | 96.4 | 105.2 | +9.0% | 400.4 | +5.8% |

| Housing and Real Estate | 24.7 | 28.1 | +13.5% | 104.1 | +6.1% |

| Bridal | 13.1 | 13.0 | -1.2% | 54.9 | -0.9% |

| Travel | 14.2 | 14.9 | +5.1% | 61.6 | +4.7% |

| Dining | 9.7 | 10.0 | +3.4% | 38.8 | +4.0% |

| Beauty | 16.8 | 18.7 | +11.1% | 72.0 | +12.9% |

| Others | 17.8 | 20.3 | +14.5% | 68.7 | +6.0% |

| HR Solutions | 83.0 | 86.6 | +4.3% | 316.8 | +7.6% |

| Recruiting in Japan | 76.8 | 78.2 | +1.8% | 283.9 | +4.9% |

| Others | 6.1 | 8.3 | +36.7% | 32.8 | +38.3% |

| Eliminations and Adjustments | 1.7 | 1.9 | +9.8% | 4.1 | -41.2% |

| Staffing | 319.9 | 304.1 | -4.9% | 1,290.2 | -0.7% |

| Japan | 128.9 | 133.4 | +3.5% | 542.5 | +6.5% |

| Overseas | 190.9 | 170.7 | -10.6% | 747.7 | -5.3% |

| Eliminations and Adjustments | (6.6) | (7.6) | - | (27.9) | - |

EBITDA

(In billions of yen)

| FY2017 | FY2018 | ||||

|---|---|---|---|---|---|

| Q4 | Q4 | YoY | Full Year | YoY | |

| Consolidated results | 42.7 | 53.1 | +24.2% | 293.2 | +13.5% |

| HR Technology | 7.3 | 10.5 | +44.1% | 47.4 | +55.0% |

| Media & Solutions*³ | 27.8 | 32.2 | +16.2% | 172.4 | +10.4% |

| Marketing Solutions*³ | 15.5 | 18.8 | +21.4% | 109.8 | +15.3% |

| HR Solutions*³ | 16.4 | 17.9 | +9.1% | 79.2 | +6.3% |

| Eliminations and Adjustments | (4.1) | (4.5) | - | (16.6) | - |

| Staffing*³ | 9.8 | 13.6 | +39.2% | 82.9 | +14.1% |

| Japan*³ | 2.7 | 6.6 | +145.7% | 43.0 | +27.3% |

| Overseas | 7.1 | 7.0 | -1.4% | 39.8 | +2.5% |

| Eliminations and Adjustments | (2.2) | (3.4) | - | (9.5) | - |

| EBITDA margin | |||||

| Consolidated results | 7.7% | 9.2% | +1.5pt | 12.7% | +0.8pt |

| HR Technology | 11.9% | 11.8% | -0.1pt | 14.5% | +0.5pt |

| Media & Solutions | 15.3% | 16.7% | +1.3pt | 23.9% | +0.9pt |

| Marketing Solutions | 16.1% | 18.0% | +1.8pt | 27.4% | +2.3pt |

| HR Solutions | 19.8% | 20.7% | +0.9pt | 25.0% | -0.3pt |

| Staffing | 3.1% | 4.5% | +1.4pt | 6.4% | +0.8pt |

| Japan | 2.1% | 5.0% | +2.9pt | 7.9% | +1.3pt |

| Overseas | 3.7% | 4.1% | +0.4pt | 5.3% | +0.4pt |

*1 The Group adopted IFRS 15 in the beginning FY2018, and changed its

accounting policy. Revenues from certain customers which were previously

presented on a gross basis with agent commissions classified in cost of

sales are now presented on a net basis. FY2017 numbers assume the same

accounting policy change was applied on a pro forma basis. The US dollar

based revenue reporting represents the financial results of operating

companies in this segment on a US dollar basis, which differ from the

consolidated financial results of the Company.

*2 Internal data

based on Google Analytics service, January 2019

*3 The treatment of

cost allocations in intra-group transactions was changed at the

beginning of FY2018, resulting in a positive impact to segment EBITDA.

Please refer to Appendix of Financial Results Summary FY2018.

3. Consolidated Financial Guidance for FY2019

The Company is changing its prior guidance practices for FY2019 to reflect its rapidly changing technology business environment. The Company will no longer provide specific full year consolidated forecasts for revenue, EBITDA, operating income, profit attributable to owners of the parent, adjusted profit and adjusted EPS.

Below are consolidated financial guidance for FY2019:

- Revenue

and adjusted EBITDA* for all three segments to increase

- Adjusted

EBITDA* to be in the range of 310 billion yen to 330 billion yen

-

Adjusted EPS to grow high single digits

The HR Technology segment revenue on a US dollar basis is expected to grow approximately 35% plus or minus a few percent. Adjusted EBITDA margin for the segment is expected to be approximately the same level as FY2018 plus or minus a few percent mainly due to continued investment in sales and marketing activities to acquire new individual users and enterprise clients and in product enhancements to increase user and client engagement.

The Media & Solutions segment revenue is expected to continue stable growth. Revenue for Marketing Solutions is expected to grow mid single digits, and revenue for HR Solutions is expected to grow low single digits. Adjusted EBITDA margin for the segment is expected to remain at a level similar to that of FY2018.

The Staffing segment revenue is expected to grow low single digits, comprised of an increase in both Japan and Overseas operations, and adjusted EBITDA margin is expected to improve slightly from FY2018 by improving operational productivity.

*Adjusted EBITDA = operating income + depreciation and amortization (excluding depreciation of right-of-use assets) ± other operating income/expenses

4. Long and Mid-term Management

(1)Long-Term Goals of Recruit Group

Provide Effective Matching Solutions

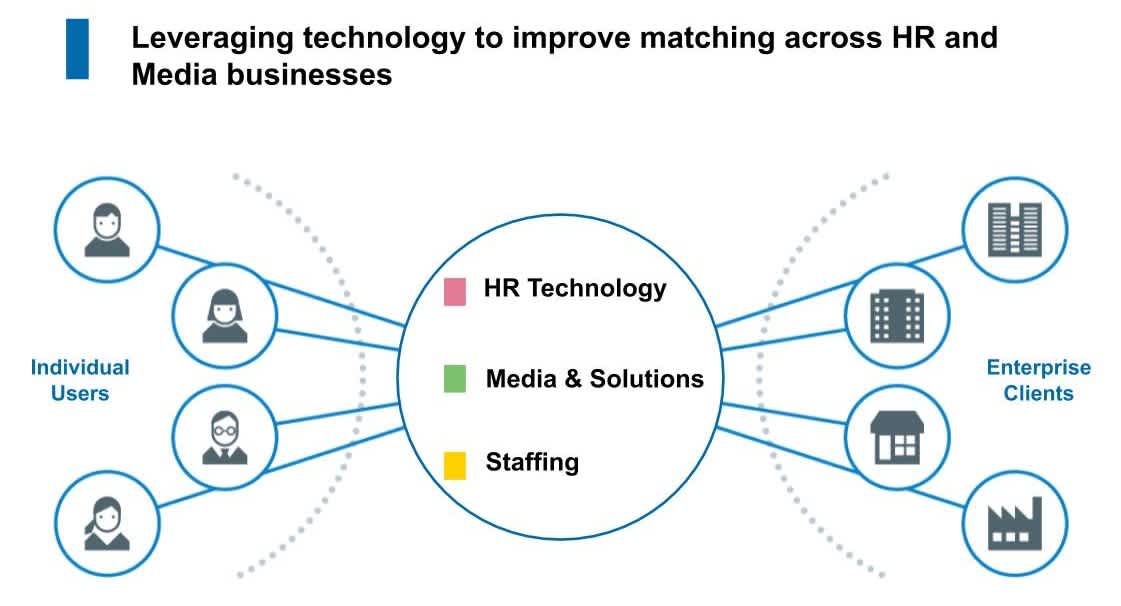

Since our foundation in 1960, the Group has a history of identifying areas where mismatching is an issue and creating value for society and customers by solving these issues. We have operated our businesses in Japan and globally, connecting individual users and enterprise clients and offering each the best matching experience.

We will continue to focus on improving our matching capabilities.

Growth and Evolution in HR Matching Market

The "HR matching market"*¹ in particular is where we will use technology to accelerate innovation and dramatically improve matching efficiency.Hiring and recruiting processes remain inefficient for companies, large and small, and we aim to leverage data and technology to solve this problem.

We aim to be a global leader in the HR matching market while promoting our own innovation and creation.

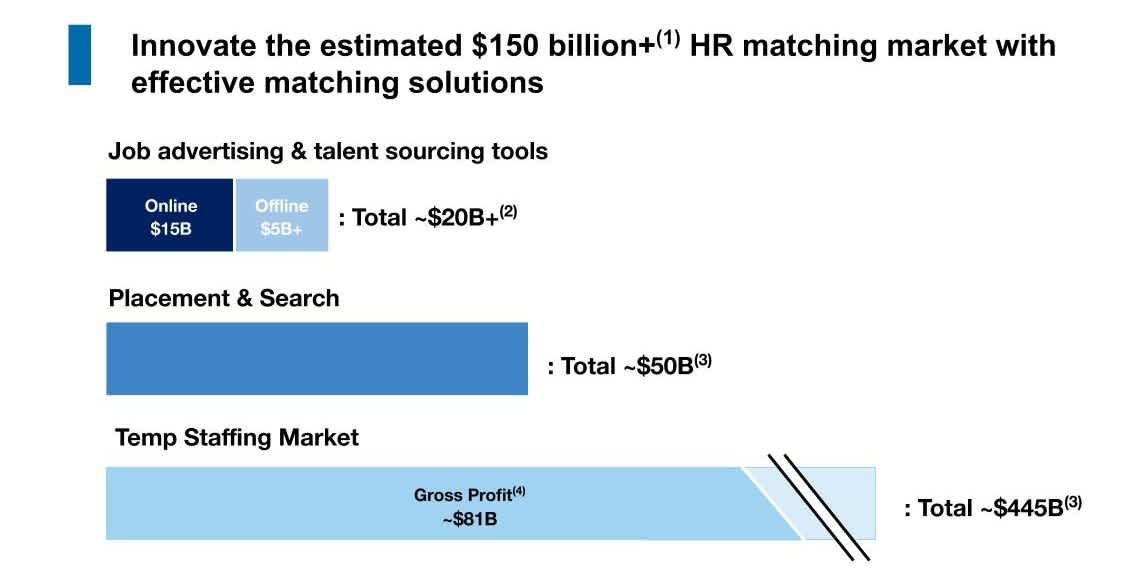

*1 The "HR matching market" is comprised of the job advertisement and recruiting tool market, the placement and search market, and the temporary staffing market.

(1) Source: SIA (Staffing Industry Analysts),

www.staffingindustry.com; 2018 company estimates, consists of the

job advertising and talent sourcing tools market, the placement and

executive search market, and the temporary staffing market (gross

profit)

(2) Source: 2018 company estimates, consists of online

job advertising, employer branding, and talent sourcing

tools

(3) Source: SIA, Global Staffing Industry Market

Estimates and Forecast: November 2018 Update, company estimates;

assumes 6% industry growth rate (2018)

(4) Assumes gross profit

margin of 18.3% calculated based on the weighted average of the top

3 publicly traded global staffing companies in terms of revenue

(2018)

We estimate the overall market size for the global HR matching market to be more than 150 billion US dollars (16 trillion yen).

The market for job advertising and talent sourcing tools, which is the primary business of the HR Technology segment, is estimated to be approximately 15 billion US dollars (1.7 trillion yen) globally in annual revenue, growing high single digits each year. We estimate the size of the US market to be approximately 6.5 billion US dollars (0.7 trillion yen).

The offline job advertising market, such as print advertisements, is also large. In the future, we expect the offline job advertising market to continue to shift online.The job advertising business in HR Solutions within the Media & Solutions segment belongs to the online job advertising market.

Also, we will focus on new business developments in the placement market and the temporary staffing market in mid-term.

The placement and executive search market is estimated to be approximately 50 billion US dollars (5.5 trillion yen), based on third party research.The placement business in the Media & Solutions segment, and Indeed Hire, which was launched last year in the HR technology segment, belong to this market.

The total revenue of the global temporary staffing market is estimated

to be approximately 445 billion US dollars (50 trillion yen) based on

third party research.

Because this estimated revenue includes

salary etc. paid to temporary staff in the staffing business, we instead

use gross profit to estimate the size for this market. Gross profit

excludes cost of sales such as staffing salary and is estimated to be

approximately 81 billion US dollars (9.0 trillion yen) annually.

We aim to become a global leader in the HR matching industry by leveraging technology to drive innovation.

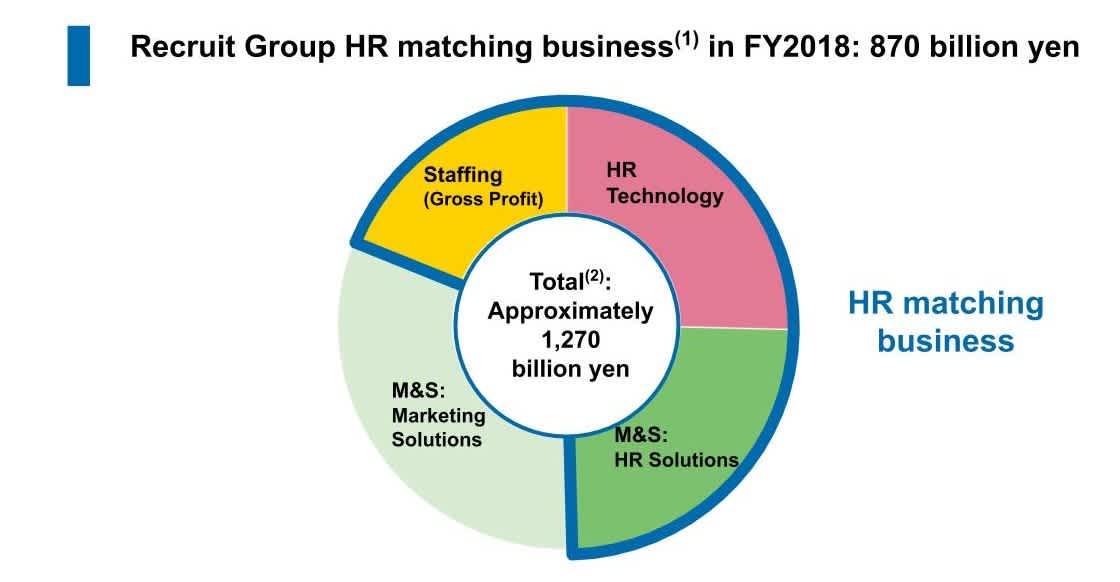

(1) Business scale of HR matching businesses comprised of revenue

of (i)HR Technology, (ii) HR Solutions in Media & Solutions and

(iii) Staffing excluding salary for temporary staff etc.

(2)

"Total" comprised of (1) and revenue of Marketing Solutions in Media

& Solutions

The Group's consolidated revenue in FY2018 was 2.3 trillion yen, of which approximately 1.27 trillion yen was revenue excluding cost of sales (particularly the pay to the temporary staff) in the Staffing segment.

The scale of the Group's existing HR matching businesses is approximately 870 billion yen.

Therefore, we have significant opportunity to continue to expand our HR matching business in an over 16 trillion yen global market.

(2)Mid-Term Segment Strategies

Overall

-

HR Technology segment

-

We aim to continue to grow our existing online job advertising businesses. We will also execute new business development and M&A and will consider collaborations with our other SBUs in the HR matching business.

-

-

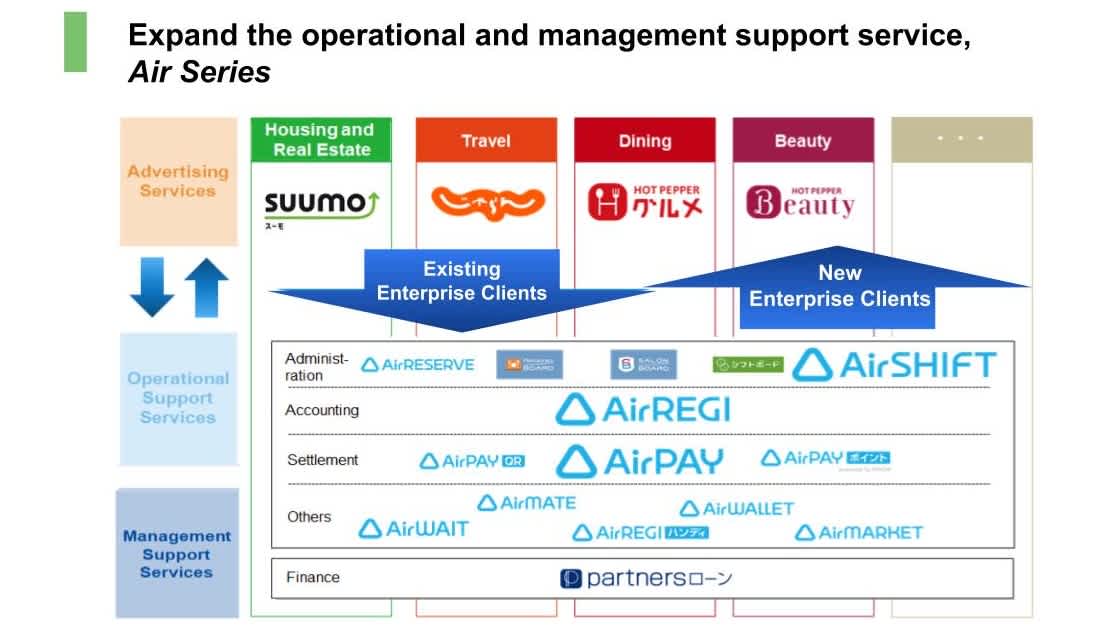

Media & Solutions segment

-

We will continue to improve our advertising business to maintain stable revenue growth.

-

In Marketing Solutions, we aim to drive further growth in these businesses by expanding our operational and management support services, which strengthen relationships with existing and new enterprise clients.

-

-

Staffing segment

-

We aim to maintain and improve our EBITDA margin, which is already amongst the highest level in the Staffing industry worldwide.

-

HR Technology segment

The HR Technology segment is the engine that drives our HR matching business.We expect the online job advertising business to grow organically, while we continue to invest in new business development and execute M&A in order to make recruiting processes more efficient.

The proportion of our Non-US business, which is approaching 30% of total revenue today, will gradually increase over time.

EBITDA of the operations outside the US turned positive in FY2018. The adjusted EBITDA margin of the existing business should increase as the business scales, and at the same time, we will continue to aggressively invest in new businesses. As a result, in the mid-term, adjusted EBITDA margin growth in the HR Technology segment overall will be modest.

We will contribute to the improvement of matching efficiency across the Group's HR matching businesses through collaboration with the other segments.

Media & Solutions segment

In the Media & Solutions segment, we will focus on steadily improving our existing advertising businesses.

In Marketing Solutions, we will offer added value to enterprise clients by providing enhanced operational and management support services in addition to our advertising businesses.

Air Series, a key component in our offered operational and management support services, is being expanded to support enterprise clients' administrative functions such as accounting, settlement, reception management, and reservation management.

We believe we can achieve stable revenue growth and maintain adjusted EBITDA margin by strengthening relationships with enterprise clients in existing advertising business and acquiring new enterprise clients with operational and management support services.

Our Air Series offerings has continued to expand.

The number of registered accounts for AirREGI has increased over the

past three fiscal years by over 70%, to more than 400,000 at the end of

FY2018.

In the Dining subsegment, we offer Operational Support

Package, which is an additional function on Restaurant Board and which

can be linked to AirREGI. The number of paying accounts using this

feature has steadily grown and reached over 28,000 paying accounts as of

the end of FY2018.

Air Pay is a payment service which currently supports 26 different

types of payment systems, the most in the industry, including credit

cards, electronic money, QR code payments, etc. The ability to use

various payment methods in a single store provides significant value to

both individual users and enterprise clients.

In particular, we

expect that demand for Air Pay will continue to grow as a result of

increasing popularity of cashless payments promoted by Government, which

has become a catalyst for introducing payment terminals at

stores.

AirSHIFT is a relatively new shift management service that streamlines

detailed coordination of employee staff assignments, and we will market

this service to SME clients such as restaurants and retail stores in the

future.

AirSHIFT is expected to contribute to HR Solutions domain

not only better operational and management support service from

Marketing Solutions but also help clients improve labor cost

efficiency.

Staffing segment

In the Staffing segment, the economic environment continues to remain unclear, especially in Europe, but we will aim to improve adjusted EBITDA margins by continuing to focus on operational efficiency in both Japan and overseas.

The Japan operations have high profitability in the global staffing industry, and we will focus on maintaining this profitability.

We will further aim to improve adjusted EBITDA margin in our Overseas operations by transferring the Group's business operations expertise to the acquired subsidiaries.

5. Governance Structure

We believe that it is essential to have a diverse Board in order to accelerate innovation needed for the Group's future growth.

Therefore, in selecting candidates for a director, we evaluate a diverse group of candidates, taking into consideration individual skills, leadership, background, judgment, personality, insight and experience, etc. from the candidate group to ensure diversity.

Currently, the Board of Directors is comprised of 6 directors. Hisayuki Idekoba has been nominated as a new Board Director, and, if he is approved at the general meeting of shareholders scheduled to be held in June 2019, there then will be 7 members on the Board.

Mr. Idekoba has a proven track record of successfully employing technology to drive growth and innovation across many of our businesses. He has also contributed significantly to the steady growth of Indeed and the globalization of the Group in recent years. Therefore, we have decided that he is the most appropriate candidate for addition to the Board of Directors.

We have been making progress regarding the composition of our Board. However, we believe there is a strong need to increase gender diversity and therefore the Board of Directors is committed to including at least one female Board Director candidate to be nominated at the General Meeting of Shareholders by June 2021.

6. Management KPIs & Financial Policy

Management KPIs

Adjusted EBITDA, which is a new management KPI, and adjusted EPS are key performance indicators for the Recruit Holdings management team.

Adjusted EBITDA is a measure that adjusts for the impact of IFRS16, which is being applied beginning in FY2019. Under IFRS16, depreciation of right-of-use assets is recorded in connection with leases instead of rent expense. To allow for comparison to prior periods, the Company has decided to use adjusted EBITDA. Adjusted EBITDA will deduct depreciation expenses for the right-of-use asset from EBITDA.

*Please refer to the Appendix of Presentation Material for the details of the adjustment.

Financial Policy

Capital Efficiency

-

ROE is a measure of capital efficiency and for FY2018 was 19.3%, significantly exceeding the targeted level. We will continue to pursue ROE at a target level of 15%.

Capital Allocation

-

Dividends

-

We view dividends as an important tool to deliver returns to our shareholders. We aim to continue to pay out consistent and stable dividends twice a year, with a target payout ratio of 30%.

-

For FY2018, the annual dividend per share will be 28.0 yen, which is comprised of the interim dividend of 13.5 yen, and the year-end dividend, which will be 14.5 yen, up 1 yen from the most recent dividend forecast.

-

-

M&A

-

We expect to utilize capital for strategic acquisitions that will help us realize our ambitious goals. We believe that in the mid-term there will be an approximate 700 to 800 billion yen surplus for strategic investments even after ensuring that the financial soundness of the Company is maintained.

-

Strategic M&A depends upon market conditions and third party negotiations and so may not be carried out every year, but we will work to retain sufficient capital that will enable us to move flexibly and quickly, if necessary. Additionally, external financing through bank lending is available for acquisitions as needed, provided that we ensure that the Company's financial soundness is maintained.

-

-

Stock buy-back

-

Depending on the capital market environment and the outlook of the Company's financial position, we may consider the possibility of executing a share repurchase program to create value for shareholders, as necessary, after meeting the above-mentioned funding needs.

-

7. Video

8. Results Materials

Latest

Investors' Kit for Q4 FY2018(3.5 MB)(ZIP)

Earnings

Release for FY2018 (866 KB)

Financial

Results Summary for FY2018 (267 KB)

Supplemental

Financial Data for FY2018(139 KB

��)(Excel)

In preparing these materials, Recruit Holdings Co., Ltd. relies upon and assumes the accuracy and completeness of all available information. However, we make no representations or warranties of any kind, express or implied, about the completeness and accuracy. This presentation also contains forward-looking statements. Actual results, performance and achievements are subject to various risks and uncertainties. Accordingly, actual results may differ significantly from those expressed or implied by forward-looking statements. Readers are cautioned against placing undue reliance on forward-looking statements. Reported results should not be considered as an indication of future performance. Forward-looking statements in this press release are based on information available to us on the date hereof. We undertake no duty to update this information unless required by law.