About

Corporate Governance

Basic Policy on Corporate Governance

Management Philosophy

The management philosophy of the Company is expressed in its Basic Principle, Vision, Mission and Values:

Basic Principle

We are focused on creating new value for our society to continue to a brighter world where all individuals can live life to the fullest.

Vision

Follow Your Heart

Mission

Opportunities for Life.

Faster, simpler and closer to you.

Values

Wow the World

Bet on Passion

Prioritize Social Value

Guided by Recruit Group Management Philosophy, the Board of Directors

prioritizes corporate governance policies and practices that are

designed to achieve long-term growth, increased corporate and

shareholder value, and benefits for all of our stakeholders. Our

stakeholders include employees, individual users and business clients,

as well as our shareholders, business partners, non-profit organizations

(NPOs) and non-governmental organizations (NGOs), national and other

governments, and local communities.

In order to further enhance

corporate value in the future, the Company believes it is important to

prosper together with all stakeholders through all corporate activities

with a sound governance foundation. Therefore, the Company has redefined

its commitment to sustainability as well as setting ESG targets, and

defines corporate governance as one of our material foundations for our

corporate activities, and prioritizes related initiatives.

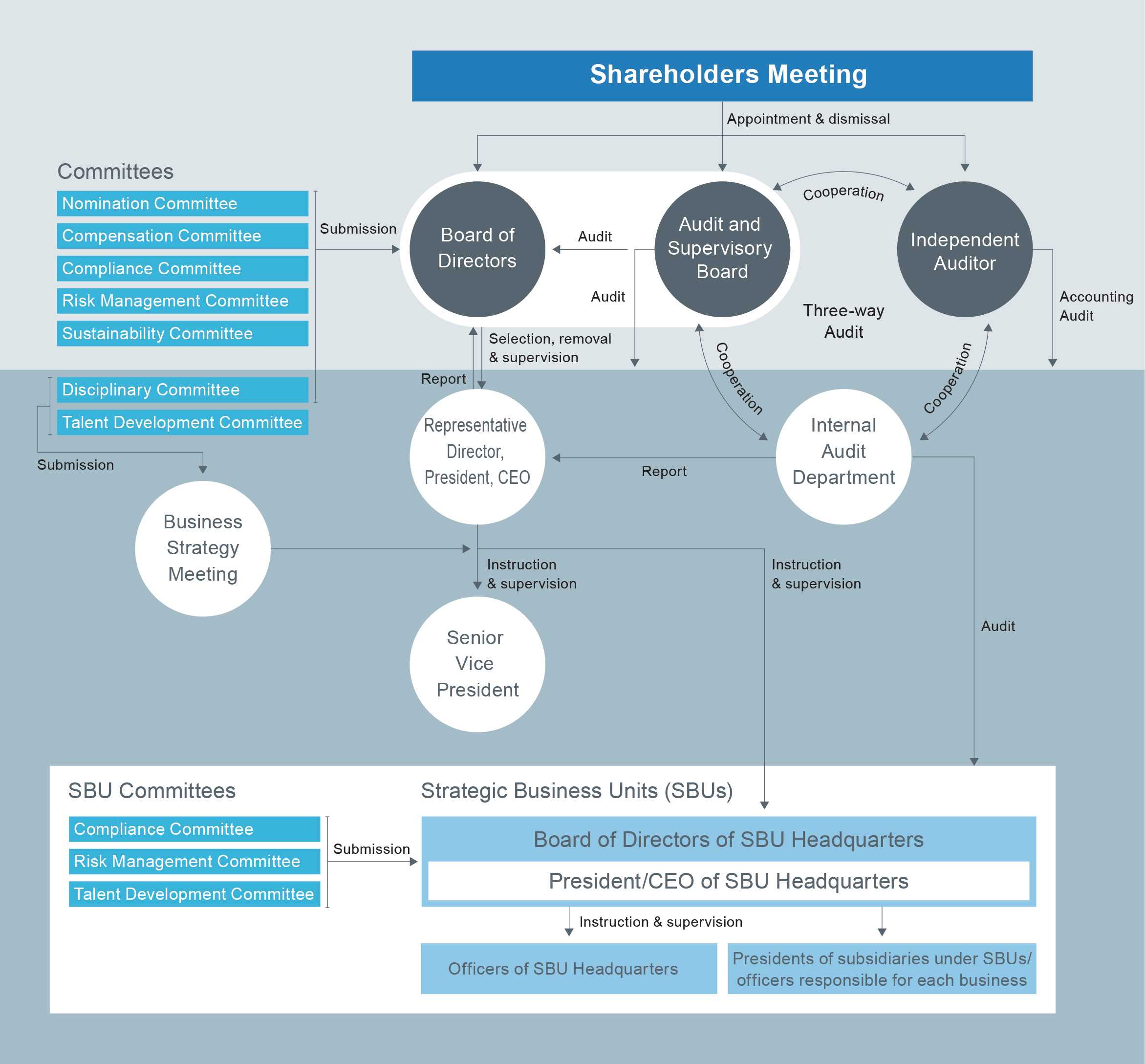

Corporate Governance Overview

The Company's corporate governance structure is a "Company with an

Audit and Supervisory Board" as defined under the Companies Act of

Japan. In this structure, Audit and Supervisory Board members appointed

by shareholders conduct audits of the execution of the duties by

Directors as an independent body from the Board of Directors. This is

the foundation for the Company’s efforts to ensure and improve

transparency, soundness, and efficiency of management.

Under this

structure, the Company has appointed multiple independent Directors of

the Board and Independent Audit and Supervisory Board Members who are

highly independent. The Company also has voluntarily established

committees to serve as advisory bodies to the Board of Directors,

including the Nomination, Compensation, Compliance, Risk Management, and

Sustainability Committees. To enhance independence, the Nomination and

Compensation Committees are all chaired by Independent Directors of the

Board and have a majority of outside members.

Annually, the Board

of Directors analyzes and assesses its own effectiveness, confirms

whether deliberations are conducted properly from the perspective of

various stakeholders, and carries out initiatives for

improvement.

Furthermore, the Company has appointed Senior Vice

Presidents, and established the Business Strategy Meeting to serve as an

advisory body to the CEO in order to enhance the Company’s

decision-making process and execution. The Business Strategy Meeting

discusses important matters for the Company and the CEO approves the

execution of such matters.

The Company has organized management

units called Strategic Business Units (“SBU”). Each SBU has established

a managing company, or SBU Headquarters, which manages the subsidiaries

of each SBU.

After deciding basic management policies and important

matters, and clarifying the scope of responsibilities, the Board of

Directors delegates certain decision-making authority to the Business

Strategy Meeting, SBU Headquarters, and other relevant

bodies.

Through this arrangement, the Company aims to ensure that

our corporate governance mechanisms are functioning sufficiently, both

in terms of timely decision-making and effective internal

control.

Corporate Governance Structure

The following are the SBU Headquarters:

-

HR Technology SBU : RGF OHR USA, INC.

-

Matching & Solutions SBU : Recruit Co., Ltd.

-

Staffing SBU : RGF Staffing B.V.

Important decisions for the SBUs are made by the Board of Directors of each SBU Headquarters. The majority of the Board of Directors of each SBU Headquarters comprises non-Executive Directors who are appointed by the Holding Company. President/CEO of SBU Headquarters concurrently serve as Senior Vice Presidents of the Holding Company.

Board of Directors

Role of the Board of Directors

The Board of Directors seeks to increase enterprise and shareholder value in the mid- to long-term. The responsibilities of the Board of Directors include:

-

Setting basic management policies to achieve the Company’s strategic objectives

-

Conducting oversight of operations and management

-

Making decisions that could have a major impact on the Company

-

Resolving matters required to be resolved by the Board of Directors as stipulated in relevant laws and regulations

Board of Directors meetings are held at least once every three months.

The Board of Directors makes decisions on matters which significantly

impact the Company’s corporate governance and/or the Company’s

consolidated financial performance, such as investments above a certain

threshold and key personnel matters. The Board of Directors delegates

authority over other business matters to the Business Strategy Meeting

and other decision-making bodies according to their appropriate level of

responsibilities.

Criteria for determining organizational

decision-making authority are set forth in the rules on decision-making

authority. These rules are reviewed annually more than once by the Board

of Directors and revised as necessary.

When proposing to shareholders that certain matters for resolution at the Annual Meeting of Shareholders be delegated to the Board of Directors, a Board of Directors meeting attended by four Independent Director of the Board and two Independent Audit and Supervisory Board members considers whether the Board of Directors is adequately constituted to fulfill its corporate governance roles and responsibilities, and whether such delegation is desirable from the perspectives of agile decision-making and expertise in business judgment.

Composition of the Board of Directors

The Board of Directors is composed of eight Directors and four Audit

and Supervisory Board members, including four Independent Directors and

two Independent Audit and Supervisory Board members.

As a result of

its growth, the Company today operates across many business sectors and

geographic locations, engages with a broad universe of individual users

and business clients, and employs people from diverse backgrounds. The

Company recognizes that the Board of Directors should reflect this

diversity to ensure that it sustains the high-quality discussions that

drive innovation and the long-term success of the Company.

As for

the size of the Board of Directors, the Company believes that the Board

of Directors should have an appropriate number of members in order to

foster high-quality discussions. Under the Company’s Articles of

Incorporation, the Board of Directors may have a maximum of eleven

Directors.

In addition, we have a structure in which different

persons serve as the Chairperson of the Board of Directors and the CEO.

We believe that checks and balances are effective and this structure

contributes to the strengthening of governance by separating the roles

of the Chairperson of the Board of Directors and the CEO.

Policy for Selecting Directors of the Board

The approach to selecting candidates for the Board of Directors is to

choose qualified personnel from a pool of diverse candidates who can

fulfill the duties and responsibilities of the position by considering

their skills, leadership and professional experience, personal

background, judgment, personality, and insight, without discrimination

based on attributes of gender, age, nationality or ethnicity. Current

Directors who are considered for renomination are evaluated on these

criteria as well as their performance on the Board and number of terms

of office. These candidates are elected individually at the Annual

Meeting of Shareholders.

In order to further improve the quality of

management decision-making, the Company is working to increase the

diversity of the Board of Directors. The Company has specifically set a

target for gender, and aims to propose candidates for election to its

Annual Meeting of Shareholders, to achieve an approximately 50% ratio of

women out of the total number of Directors and Audit and Supervisory

Board members by FY2030. As of June 27, 2023, four of the twelve members

of the Board of Directors including Audit and Supervisory Board members

are women.

The Company has a policy that at least one third of the

Directors are Independent Directors who maintain appropriate separation

from management execution. As of June 27, 2023, there are eight

Directors, of which four are reported as Independent Directors to the

Tokyo Stock Exchange. Independent Directors are selected based on the

above criteria as well as their management experience at corporations

operating globally and/or that are publicly listed.

The Company

expects Independent Directors to play the following roles in addition to

supervising the management of the Company:

-

To provide the Company with advice based on their management experience in corporations operating globally and/or that are publicly listed, which are necessary for the Company to further enhance its enterprise value and shareholder value in the mid-to long-term period.

-

To play a leading role in matters related to selection and dismissal, compensation and evaluation of Directors and Senior Vice Presidents as a chair and/or member of the Nomination and Compensation Committees.

-

To oversee decision-making in cases where any potential conflict of interest exists between Directors and the Company. The Board of Directors acts as the decision-making body for matters that may cause conflicts of interest by ensuring the decision is delivered under the presence of Independent Directors as well as independent Audit and Supervisory Board members.

In order to ensure that Independent Directors fulfill the above roles, the Company takes the following measures:

-

To share and discuss the topics discussed during the Compliance Committee and Risk Management Committee with the Board of Directors for the purpose of creating an environment that allows Directors and Senior Vice Presidents to take appropriate risks when making decisions.

-

To share and discuss the topics discussed during the Sustainability Committee as well as the voice of our shareholders with the Board of Directors for the purpose of ensuring the discussions at the Board appropriately reflect the diverse perspectives of our stakeholders.

In addition to the above mentioned Independent Directors, the Board appoints one non-Executive Director who does not execute business operations, but who has in-depth knowledge of and experience in the Internet industry.

Concrete Agenda of the Board of Directors

In addition to monitoring the management execution such as business performance and risks, the Board of Directors mainly discussed the following agenda during FY2022.

-

Business portfolio strategy

-

Sustainability strategy

-

Corporate governance structure

-

Capital policy and shareholder returns

Audit and Supervisory Board

Role of the Audit and Supervisory Board

The Audit and Supervisory Board is responsible for the following:

-

Supervising the activities and performance of each Director as well as the Board of Directors as a whole and auditing the maintenance and operational status of internal control policies, procedures, and processes, based on the audit plan.

-

Evaluating the appropriateness and performance of the Independent Auditor.

All members of the Audit and Supervisory Board attend the Board of

Directors meetings as part of their oversight responsibilities. In

addition, one or more standing Audit and Supervisory Board members must

attend the Business Strategy Meeting to enhance the oversight

function.

The Audit and Supervisory Board generally meets once a

month and holds extraordinary meetings as needed.

Composition of the Audit and Supervisory Board

The Audit and Supervisory Board comprises four members, including two independent members. One substitute Audit and Supervisory Board member has been elected, in order to avoid any potential non-compliance with the statutory requirement that at least half of the members of the Audit and Supervisory Board be independent members.

Policy for Selecting Audit and Supervisory Board Members

The approach to selecting candidates for the Audit and Supervisory

Board is to select qualified persons with suitable experience and

capabilities and with the necessary knowledge in the areas of finance,

accounting, and legal affairs, to fulfill the duties and

responsibilities as an Audit and Supervisory Board member. The Company

has two standing Audit and Supervisory Board members who deeply

understand the business of the Company, and two independent Audit and

Supervisory Board members, one with expertise in legal affairs and one

with expertise in finance and accounting.

All the Audit and

Supervisory Board members make efforts to continuously expand their

knowledge in order to fulfill their audit function in areas such as

finance, accounting, and legal affairs through appropriate training

courses funded by the Company. For example, the Audit and Supervisory

Board members seek to deepen their understanding of the latest

accounting standards and important matters for auditing by taking

relevant training and seminars offered by the Japan Audit and

Supervisory Board Members Association or by outside audit and assurance

firms.

Nomination and Compensation Committees

The Nomination and Compensation Committees advise the Board of

Directors. Each committee has a majority of independent members and is

chaired by an independent Director in order to enhance the transparency

and objectivity of the decision-making process.

These committees

review and consider the nomination, evaluation, and compensation of

Directors and Senior Vice Presidents in each fiscal year. Final

decisions are made by resolution of the Board of Directors.

The

roles of each committee are as follows:

Nomination Committee

The Nomination Committee deliberates on the nomination, succession and

dismissal of the CEO, and appropriateness of the process for nominating

and dismissing candidates for Directors and Senior Vice

Presidents.

In the latest fiscal year the three main topics

deliberated by the Nomination Committee were as follows:

-

Nomination and succession planning of the CEO

-

Governance structure and skills matrix of the Board of Directors

-

Appropriateness of the process for nominating candidates for Directors and Senior Vice Presidents

Compensation Committee

The Compensation Committee deliberates on policies relating to the

determination of compensation for Directors and Senior Vice Presidents,

evaluation procedures, compensation structure, the individual evaluation

of Directors and Senior Vice Presidents, as well as individual

compensation amounts.

In the latest fiscal year the three main

topics deliberated and approved by the Compensation Committee were as

follows:

-

Individual performance evaluation for the latest fiscal year

-

Compensation levels and metrics for performance-based compensation for the following fiscal year

-

Proposal for revision of maximum amount of compensation for independent Directors submitted to the Annual Meeting of Shareholders held on June 26, 2023.

Business Strategy Meeting and Other Voluntary Committees

Compliance Committee

An advisory body to the Board of Directors chaired by the Representative Director, President and CEO. The Committee deliberates on compliance themes and measures of the Company. The Committee decides and evaluates action plans based on the information collected from the Holding Company’s administrative departments and subsidiaries. The Compliance Committee’s deliberations and decisions are reported to the Board of Directors for promoting a compliance mindset.

Risk Management Committee

An advisory body to the Board of Directors chaired by the Executive Vice President and Director in charge of the Risk Management Division. The Committee deliberates on key risk themes and measures of the Company. The Committee monitors the status of risk management at each SBU as well as identifies and determines the risks deserving of particular attention, which are reported to the Board of Directors.

Sustainability Committee

An advisory body to the Board of Directors chaired by the Executive

Vice President and Director in charge of sustainability. The Committee

deliberates on the Company’s sustainability strategy and monitors its

progress. The Committee’s participants include the CEO, the Chairperson,

the Director in charge of sustainability, Senior Vice Presidents who are

in charge of each SBU, and outside experts.

The Committee addresses

important sustainability agendas of the Company, such as discussions to

achieve the ESG commitment set forth as a management strategy, aiming to

prosper together with all stakeholders. Based on the Committee’s

deliberation, the Board of Directors then resolves the direction and

action plans that promote the Company’s sustainability activities, and

monitors the progress.

Business Strategy Meeting

An advisory body to the CEO and chaired by the CEO, the meeting attendees deliberate on matters mainly relating to investments and personnel for which authority has been delegated by the Board of Directors. The meeting consists of Executive Directors, Senior Vice Presidents in charge of corporate functions and standing Audit and Supervisory Board members.

Talent Development Committee

An advisory body to the Business Strategy Meeting with participation by Senior Vice Presidents of the Company, the Committee deliberates on matters concerning the fostering of key talent, including the planning and monitoring of their career development and professional growth.

Disciplinary Committee

An advisory body to the Board of Directors and Business Strategy Meeting, the Committee deliberates on the recommended disciplinary action for the Company’s personnel including its employees.

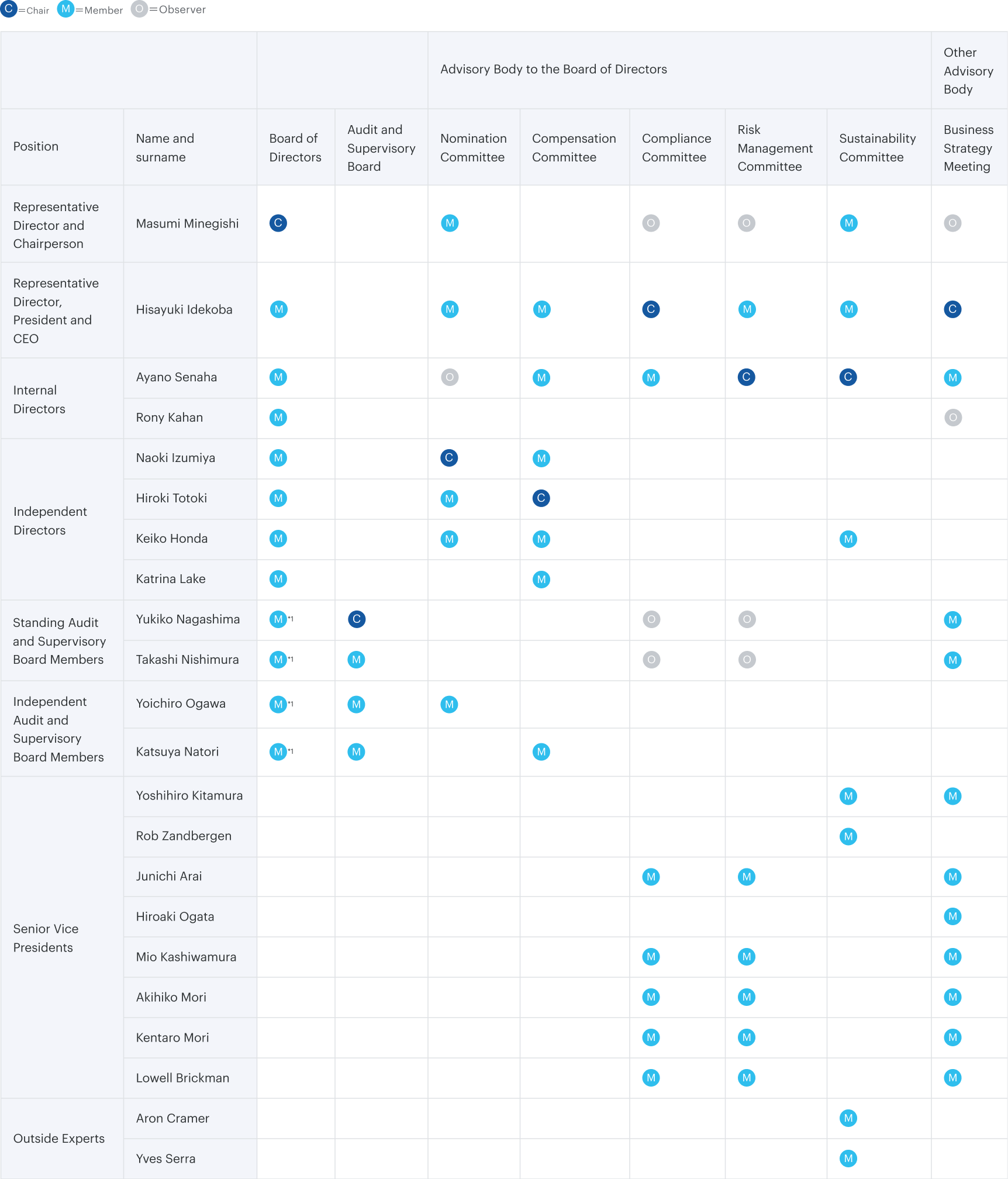

Composition of the Board and Committees as of June 27, 2023

*1Audit and Supervisory Board members are required to attend the Board of Directors meetings to audit the execution of duties of Directors under the Companies Act of Japan.

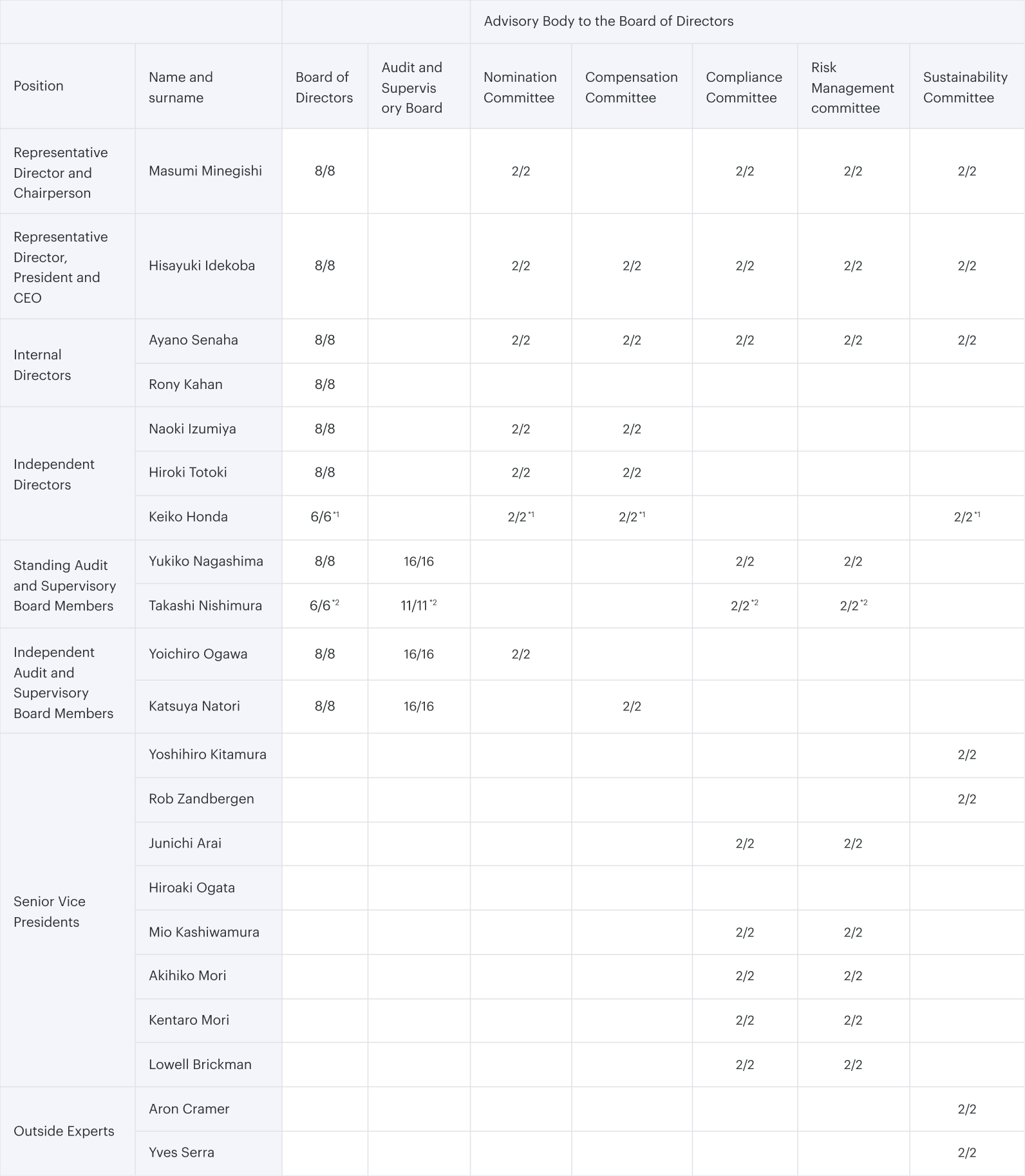

Attendance for FY2022

*1 Six meetings of the Board of Directors, two Nomination

Committees, two Compensation Committees as well as two

Sustainability Committees were held since the person was appointed

as Director at the Annual Meeting of Shareholders held on June 21,

2022.

*2 Six meetings of the Board of Directors, eleven Audit

and Supervisory Board, two Compliance Committees, as well as two

Risk Management Committees were held since the person was appointed

as Audit and Supervisory Board member at the Annual Meeting of

Shareholders held on June 21, 2022.

The Skill Matrix of Board of Directors

Analysis and Evaluation of the Effectiveness of the Board of Directors

Overall comment

We assess the effectiveness of the Board overall annually, and review and implement improvement measures for the issues identified. As a result of evaluation of the effectiveness of the Board of Directors meetings for FY2022, the Board played an appropriate role, and the Board exercised its responsibilities appropriately, both in the supervision of, and decision-making over, execution. The Board is highly effective. The Board will further improve its effectiveness based on the issues identified through the evaluation process to continue to increase the corporate value and shareholder value as an attractive corporation for all stakeholders.

Evaluation method

As a method of evaluation, the secretariat of the Board leads the survey of directors and Audit and Supervisory Board members and obtains individual opinions from independent directors and Audit and Supervisory Board members. The result of the analysis is deliberated at the Board and reflected on the agenda for the following year and various measures. We have adopted this method with the understanding that the self-assessment by directors and Audit and Supervisory Board members who have deep understanding of the status of the Company is highly effective. In addition, the Board of Directors' effectiveness evaluation in the previous fiscal year confirmed that the Board of Directors is capable of open discussion.

Initiatives based on the evaluation of effectiveness for FY2021

Below initiatives were implemented and making progress with regard to the issues identified at the previous fiscal year’s evaluation, i.e., (1) measures to further enhance deliberations by the Board of Directors and (2) measures to further strengthen the management structure:

-

Measures to further enhance deliberations by the Board of Directors

-

On-site meetings, which had been postponed due to the spread of the new coronavirus infection, resumed in June 2022, and board members held intensive discussions on a wide range of topics, including short-term business environment outlook and medium- to long-term strategy discussions.

-

-

Measures to further strengthen the management structure

-

The addition of one new independent Director in June 2023 has increased the diversity of the Board of Directors in terms of nationality, age, gender, and other attributes, in addition to strengthening the Board's overall knowledge of technology, listing on the U.S. stock market, and corporate management.

-

Measures based on the results of the Board of Directors' evaluation for FY2022

The Board of Directors has confirmed that it will prioritize the following measures to further improve the effectiveness of the Board of Directors through the effectiveness evaluation for FY2022.

-

Measures to further strengthen the management structure

-

Consideration of medium- and long-term options, etc., centered on the Nomination Committee, regarding the diversification and independence with respect to the composition of the Board of Directors and the strengthening of the executive structure, including the executive directors.

-

-

Measures to further enhance deliberations by the Board of Directors

-

To continue deliberations on "Business Portfolio Strategy and Associated Risk Management," "Capital Market Strategy" and "Sustainability Transformation" as important discussion topics for the Company this year.

-

Ongoing on-site meetings to enhance mid- to long-term strategy discussions.

-

Policy for correspondence to Corporate Governance Code

The contents of this page comply with the revised Corporate Governance

Code published by the Tokyo Stock Exchange on June 11, 2021. The Board

of Directors is recognized as being in compliance with all items of the

Corporate Governance Code.

For more information, please refer to

the Corporate Governance Report.

In this Corporate Governance Report, moreover, in addition to items for which mandatory disclosure is indicated in the Corporate Governance Code, the Board of Directors has stipulated the policy that other principles and supplementary principles relevant to the Company are to be disclosed to the extent possible.