On April 1, 2022, Recruit released AirCASH, a new product of the Air BusinessTools suite designed to cash out future sales for businesses as well as streamline business and administrative operations. We spoke with Issei Tomita, Product Manager of AirCASH, about the challenges of small and midsize businesses (SMBs) that triggered the need for this service, as well as his vision for the future.

SMBs Need Relatively Small Amounts of Capital to Implement In-Store Updates

During the forced store closures caused by the COVID-19 pandemic (and even up until today), many businesses across Japan have considered renovating or making small updates to their shops before welcoming in-store customers again. For example, many businesses want to introduce digital transformation (DX) tools to improve work efficiency, maintain or update their boiler, air conditioner, and interior units, and so on.

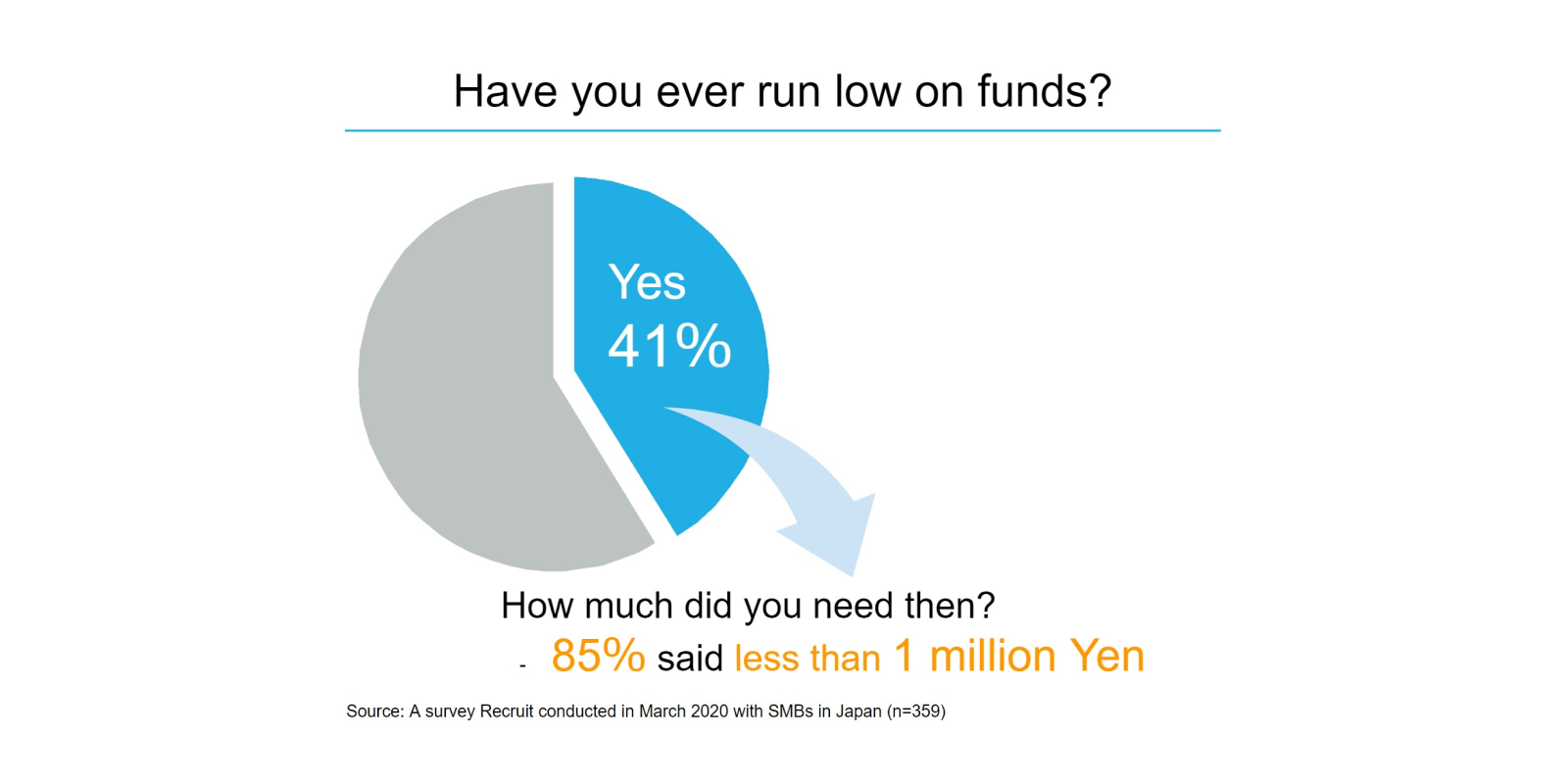

For SMBs that cannot immediately afford these investments, borrowing the funds is one option toward implementing the changes. Research indicates that SMBs do not need a large amount of capital for general costs. A March 2020 survey conducted by Recruit found that 85% of business owners were seeking a relatively small amount of capital — less than one million yen.

Still, many business owners are hesitant to borrow money from financial institutions and put off these investments if they cannot cover them with their own funds.

Issei, who joined Recruit in 2005, began recognizing these struggles while interacting with SMB clients in various industries, including hotels/traditional inns, restaurants, beauty salons, and local retail shops. Issei realized that engaging with financial institutions and raising capital are often big headaches for SMB owners.

"I felt that because financial institutions do not provide small amount loans quickly, it was hindering SMBs from improving productivity and creating value-added services," said Issei. It was this realization, he says, that prompted the concept of AirCASH.

For Smoother and Faster Money Flow

Recruit launched AirCASH on a trial basis in 2021 before releasing the full-scale service on April 1, 2022. “AirCASH,” Issei says, “has two unique features; it offers a simple digital user experience (with AirPAY compatibility) with a funding plan that cashes out the user’s expected pay-outs before a business receives them.”

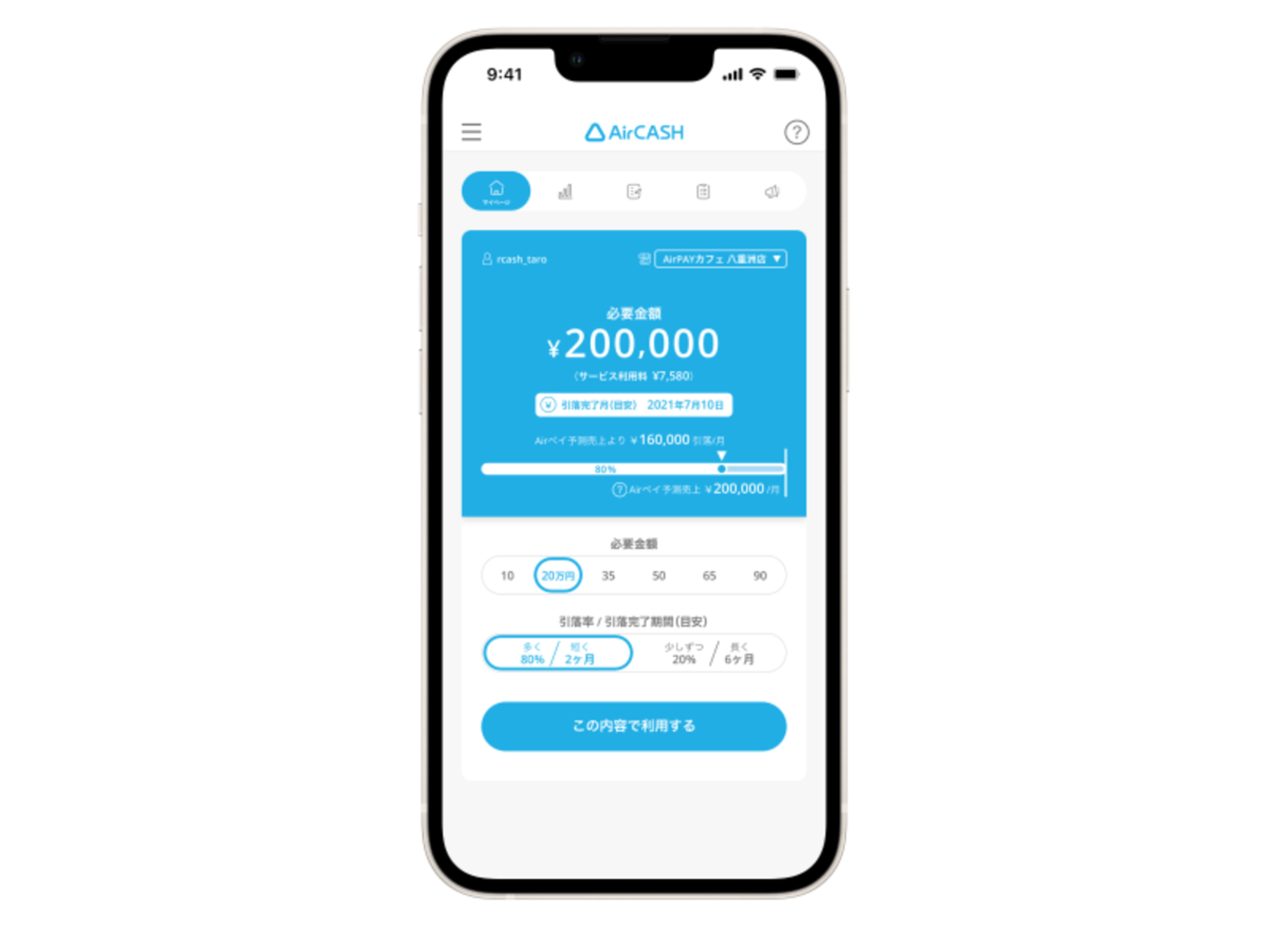

“We have thoroughly focused on making the user experience overwhelmingly faster and simpler. We have an accumulated digital transaction record for our business clients who are already using AirPAY — Recruit’s payments service for stores that accept credit cards, e-money, QR Code*¹, and royalty points. Utilizing that AirPAY information, we have simplified the financing process by building a system where users can procure money just with two taps on their smartphone, even without inputting any letter."

To apply for funding on AirCASH, users need only to tap twice to select the required fund amount and deduction plan, which removes the troublesome input or paperwork. It is possible for the funds to arrive in the user’s bank account the next day at the earliest, so they may receive the money when they need it and use it for any business-related purpose. Business owners do not have to worry about checking bank account balances or arranging wire transfers since the amount is automatically deducted from AirPAY settlement amounts.

Users can secure funds with only two taps on their smartphone

"AirCASH is not a loan. The service is more similar to transferring credits between businesses and automatically cashes out businesses’ expected account receivables in advance. We believe this would make it easier for SMB owners to take a positive step forward in implementing new business updates and tools."

Since its release, AirCASH has been used by many shops in Japan including restaurants, beauty salons, and local retail stores. We have received positive feedback from these businesses:

"It’s fast and easy to use, from application to transferred funds."

"It got rid of my anxiety as I could get enough cash on hand."

"I tried using AirCASH as a trial, but I actually love it because it doesn’t have any impact on my personal credit record."

* “QR Code” is a registered trademark of DENSO WAVE INCORPORATED.

To Increase Opportunities By Smoothing Money Flow

Regarding the future, Issei says, "I want to make the money flow smoother and faster. Just as the speed of information flow in the world is getting faster, I feel that we can make the money flow faster, too.”

Currently, large sums of money are often placed on hold in between transactions; an average retaining period of B2B transactions is 1.8 months. At the same time, some office workers are not paid their current monthly salary until the following month.

“By reducing, and even eliminating, the transactional retaining period, Recruit can help businesses access capital faster so they can take on the new challenges without missing opportunities. Smoother money flow creates more sources of opportunities."

Recruit hopes that AirCASH, which can simply and quickly provide SMBs with funds in a way that suits their financial health, will play a role in helping businesses take on small, positive challenges.

"If SMBs use AirCASH and improve the quality of the services they provide, and if it becomes easier for them to improve work efficiency and work environments, it should increase the happiness of their customers and employees. That way, we can make Japan more energetic."

Links:

News

Release on 1 April 2022: Full-scale launch of AirCASH

AirCASH

service website (Available in Japanese only)

Issei Tomita

Product Manager of AirCASH Recruit Co., Ltd.

Issei first joined Recruit in 2005 as a media producer. He went on to engage in strategy planning in sales promotion at Recruit before leaving briefly for another opportunity. He rejoined Recruit in 2013 to participate in ID strategy planning and the preparation for the launch of this SMB service in the FinTech Promotion department. He was appointed Product Manager of AirCASH in August 2020.