Investor Relations

Investor Relations Policy

Investor activity guidelines

Our basic policy for Investor Relations (IR) activities is to disclose relevant information in a timely, fair, and accurate manner to various stakeholders, particularly capital market participants including shareholders, investors, and analysts. This information is useful for corporate valuations and investment decisions, and includes our corporate policies, financial performance, business strategies, and other key figures.

Accordingly, we will create extensive opportunities, such as interviews with domestic and overseas institutional investors and analysts, and earnings results briefings, for dialogue with participants in capital markets. We also utilize our IR website and other tools to actively disclose important information that will be useful for making investment decisions.

Basic policy on timely disclosure of information

In accordance with the Financial Instruments and Exchange Act, the Rules Concerning the Timely Disclosure of Corporate Performance by Issuers of Listed Securities as stipulated by the Tokyo Stock Exchange, and other regulations, it is our basic stance to implement disclosure in a timely and appropriate manner, and also to actively disclose important information which we believe will have an impact on investment decisions.

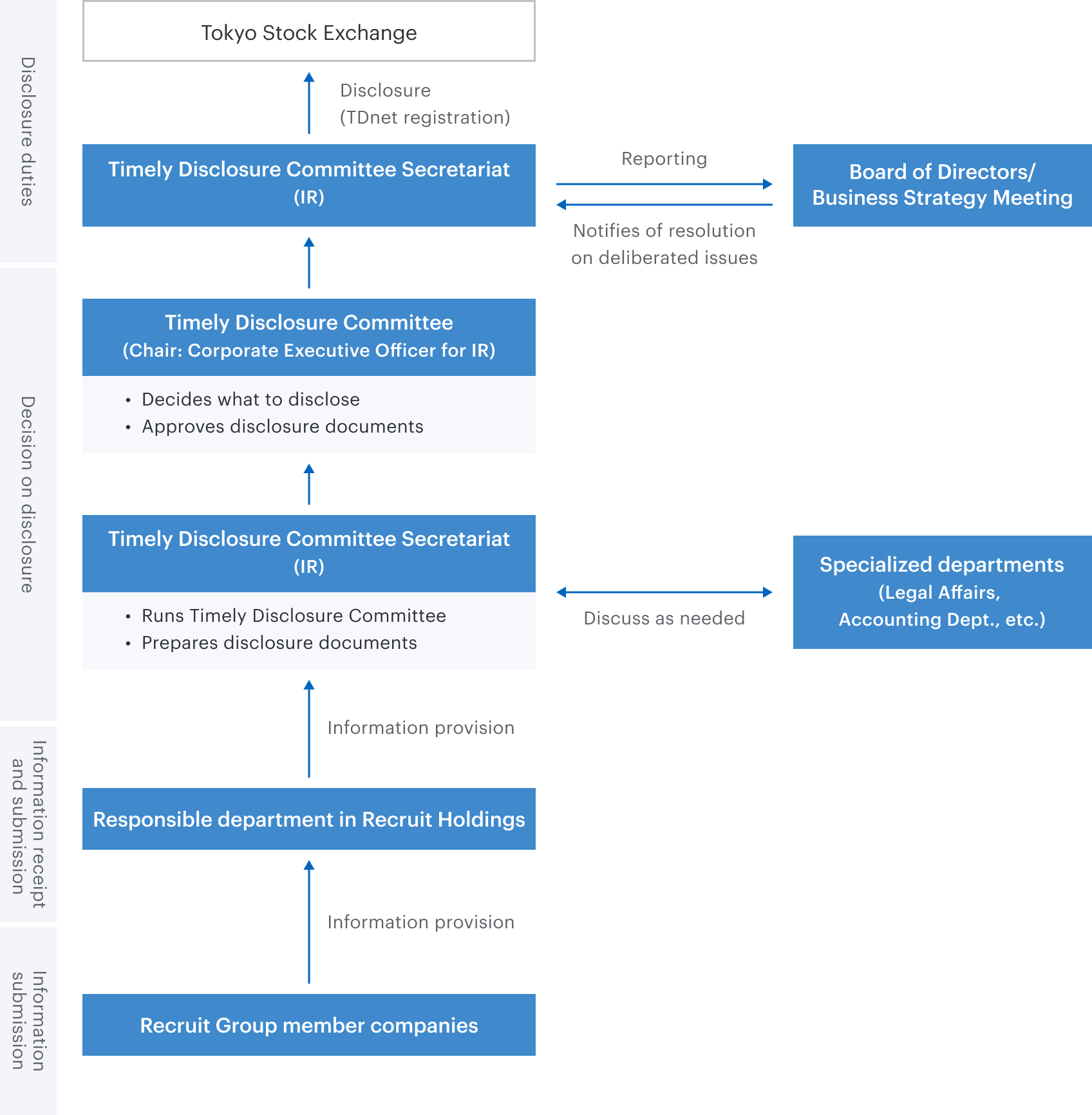

Organization for Ensuring Timely Disclosure

Quiet period policy

The period from the end of each quarter until the announcement of financial results is treated as a quiet period, during which we refrain from responding to questions and making comments about financial results to prevent information leaks and ensure fair disclosure. However, should an event arise that requires immediate disclosure during this period, we will disclose the related information in a timely and appropriate manner.

Measures to Encourage Participation in the Annual Meeting of Shareholders and Exercising Voting Rights

Policy

The Company recognizes that the annual meetings of shareholders provide an opportunity for constructive dialogue with shareholders. Therefore, we have developed an appropriate environment for the exercise of voting rights at the general meetings of shareholders, including appropriate scheduling of the meeting and related events, prompt delivery of the convocation notice of the meeting, posting of the convocation notice on this website prior to delivery, participation in the electronic voting platform, and translation of the convocation notice into English.

Prompt Delivery of Notice of Annual Meeting of Shareholders

The Company endeavors to send the Notice of Annual Meeting of Shareholders in a timely manner to ensure shareholders have sufficient time to examine the proposals that are to be voted on at the Annual Meeting of Shareholders. The Notice of Annual Meeting of Shareholders is published in both Japanese and English on the Company’s website and on TDnet at least one week before the mailing date.

Scheduling Annual Meeting of Shareholders To Avoid the Peak Day

The Annual Meeting of Shareholders was held on Jun. 17, 2021.

Electronic Exercise of Voting Rights

Shareholders can exercise their voting rights online via their own personal computers or smartphones.

Participation in the electronic voting platform and other measures to improve the environment for exercising voting rights by institutional investors

The Company participates in the electronic voting platform operated by ICJ, Inc. for both Japanese and overseas institutional investors.

Provision of a Summarized Notice of Annual Meeting of Shareholders in English

The Company uploads a Notice of Annual Meeting of Shareholders in English to its website.

Others

The Company posts the convocation notice on its website prior to its dispatch by mail.