Newsroom

- IR

Q2 FY2018 Financial Results

Nov 13, 2018 | Recruit Holdings Co., Ltd.

Recruit Holdings Co., Ltd. announces the consolidated financial results for the six months ended September 30, 2018 (April 1, 2018 to September 30, 2018). Please see below for the details.

1.FY2018 1st Half Highlights

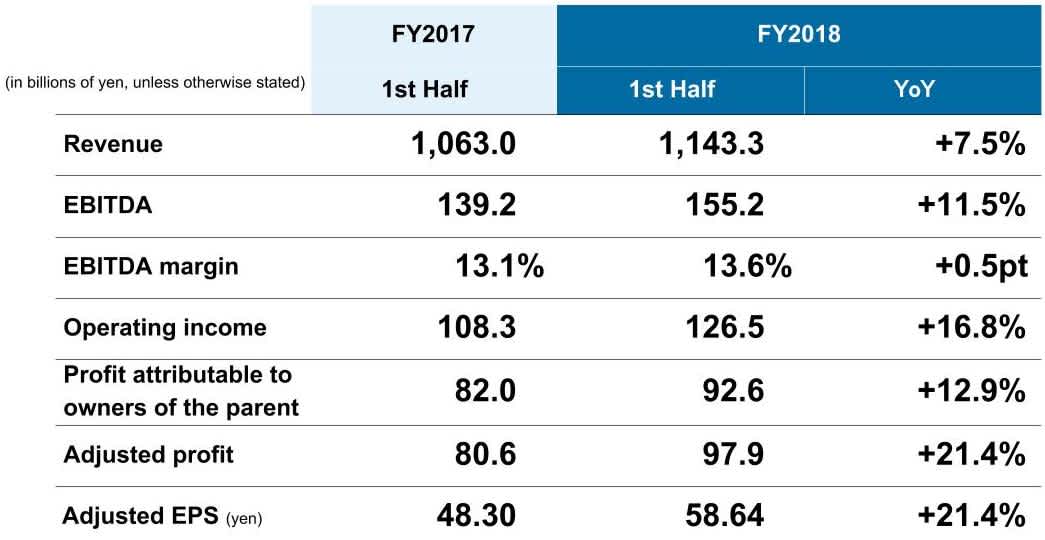

Consolidated revenue +7.5%, EBITDA +11.5%, adjusted EPS +21.4%.

-

Revenue and EBITDA grew in all three segments: HR Technology, Media & Solutions and Staffing.

Strong YoY revenue growth continued in HR Technology

-

Revenue increased +59.2% in US dollar terms, assuming IFRS 15 applied in FY2017*¹

-

Profits and losses of Glassdoor were included in the consolidated results in Q2 FY 2018

*1 These are the financial results of operating companies in the HR Technology segment, which differ from the consolidated financial results of Recruit Holdings Co., Ltd. Assuming IFRS 15 was applied in FY2017 on a pro forma basis.

2.Consolidated Financial Results - Q2 FY2018 -

The consolidated revenue for the first half of fiscal year 2018

increased 7.5% year on year to 1 trillion 143.3 billion yen. EBITDA grew

11.5% to 155.2 billion yen, and EBITDA margin was 13.6%.

Operating

income increased 16.8% year on year to 126.5 billion yen. This was

mainly due to an increase in EBITDA, and a non-recurring gain resulting

from the sale of subsidiaries. Adjusted EPS, excluding non-recurring

income and losses, grew 21.4% year on year.

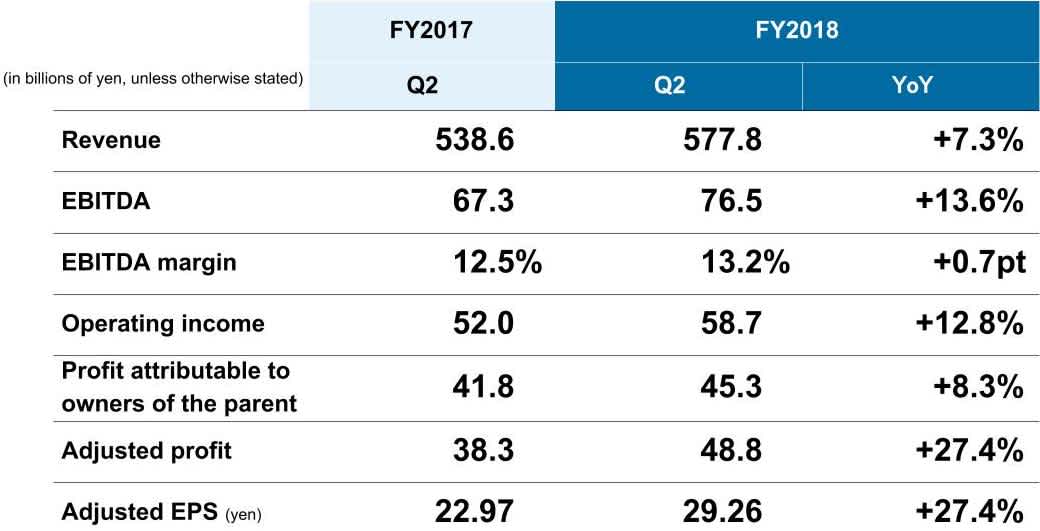

Quarterly revenue for Q2 FY2018 increased 7.3% year on year to 577.8 billion yen. EBITDA grew 13.6% to 76.5 billion yen, and EBITDA margin was 13.2%. Operating income increased 12.8% year on year to 58.7 billion yen. Adjusted EPS, excluding non-recurring income and losses, grew 27.4% year on year.

3.Financial Results by Segment - Q2 FY2018 -

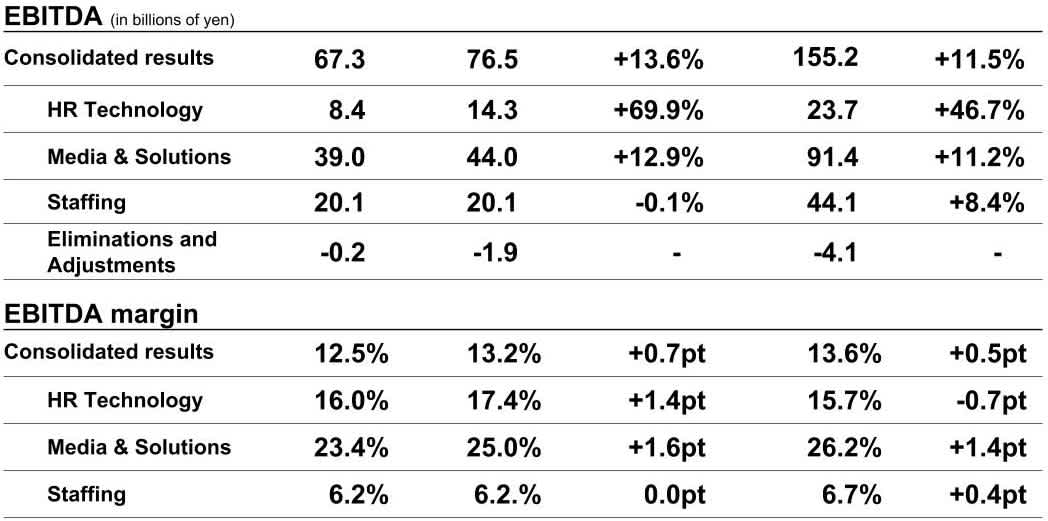

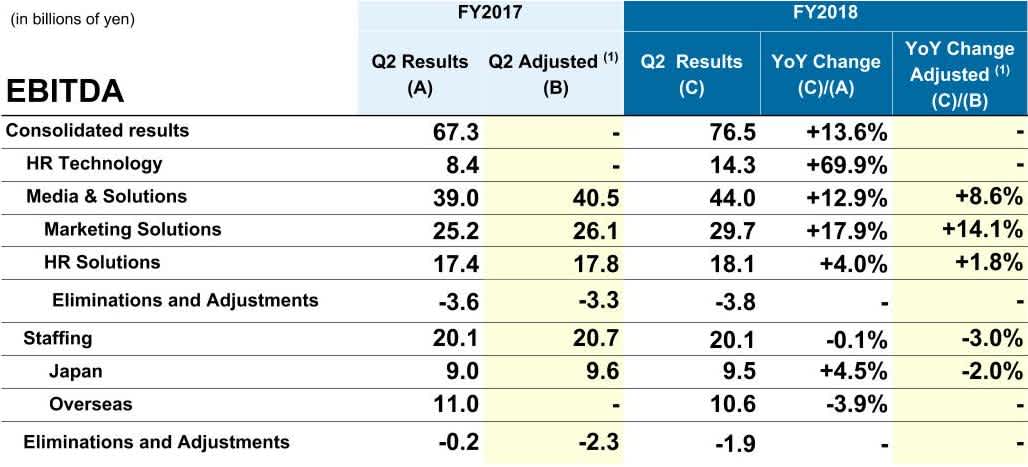

All three segments delivered an increase in revenue and EBITDA in the

first half of FY2018.

There was the impact of the change in

treatment of intra-group transactions on segment EBITDA resulting from

the group reorganization, as I previously explained in Q1 FY2018.

Impact to Segment EBITDA due to Change in Intra-Group Transactions

(1) Assuming the change in intra-group transactions such as

management service fees and general administrative fees was applied

in Q2 FY2017. Calculated based on managerial accounting

figures.

* There is no impact on the HR Technology segment and

overseas operations of the Staffing segment from this change in

treatment of intra-group transactions.

Due to the group reorganization which was put into action from last year, the treatment of cost allocations in intra-group transactions such as management service fees and general administrative fees was changed at the beginning of Q1 FY2018, positively impacting quarterly EBITDA in the Media & Solutions segment and in the Japan operations of the Staffing segment. There was no impact on the HR Technology segment and overseas operations of the Staffing segment from this change in treatment of intra-group transactions.

HR Technology

(1) These are the financial results of operating companies in the

HR Technology segment, which differ from the consolidated financial

results of Recruit Holdings Co., Ltd.

(2) Assuming IFRS 15 was

applied in the previous fiscal year on a pro forma basis.

In the HR Technology segment, quarterly revenue was up 56.4% year on year, and up 55.1% on a US dollar basis. Profits and losses from Glassdoor's operations were included in the HR Technology segment's results in the second quarter.

We reassessed the identification of a customer based on the IFRS 15 definition in Q2 FY2018, and revenue is reported net of agency commissions whereas in prior periods revenue was reported on a gross basis and agency commissions were classified in cost of sales. Assuming the IFRS 15 definition was applied in the previous fiscal year, quarterly revenue of the HR Technology segment increased 60.6% year over year on a US dollar basis.

Quarterly EBITDA margin was 17.4%, an increase of 1.4 points year on year. The reassessment of the identification of a customer had no impact on EBITDA.

To support future revenue growth, the HR Technology segment continued to make substantial investments in sales and marketing to drive user and customer acquisition, and in products and engineering to build enhanced functionality for job seekers and employers. These investments are expected to continue to fluctuate throughout the year.

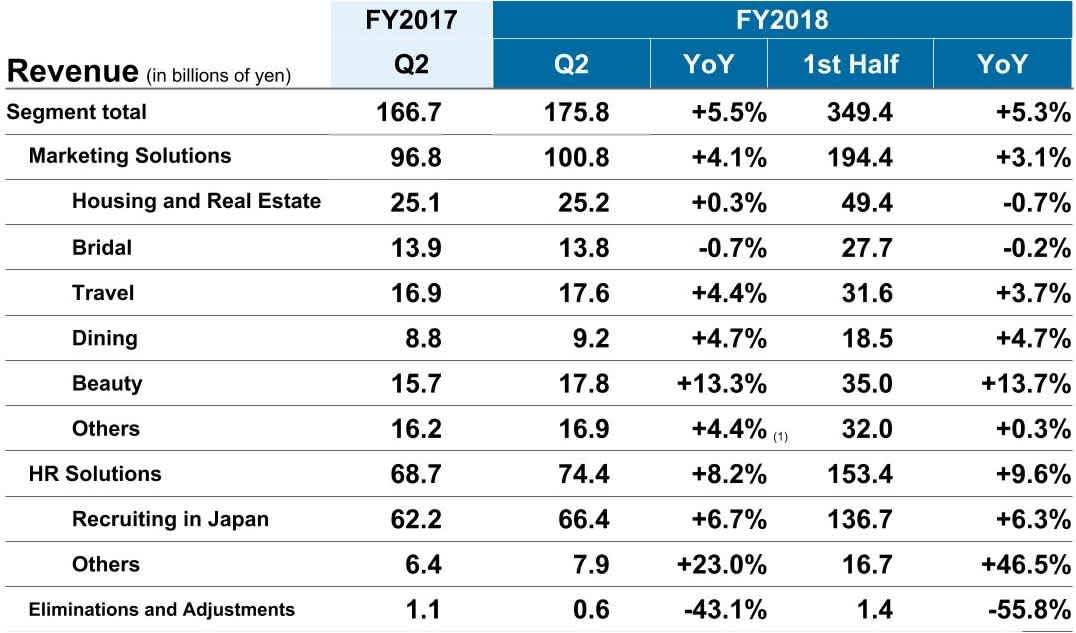

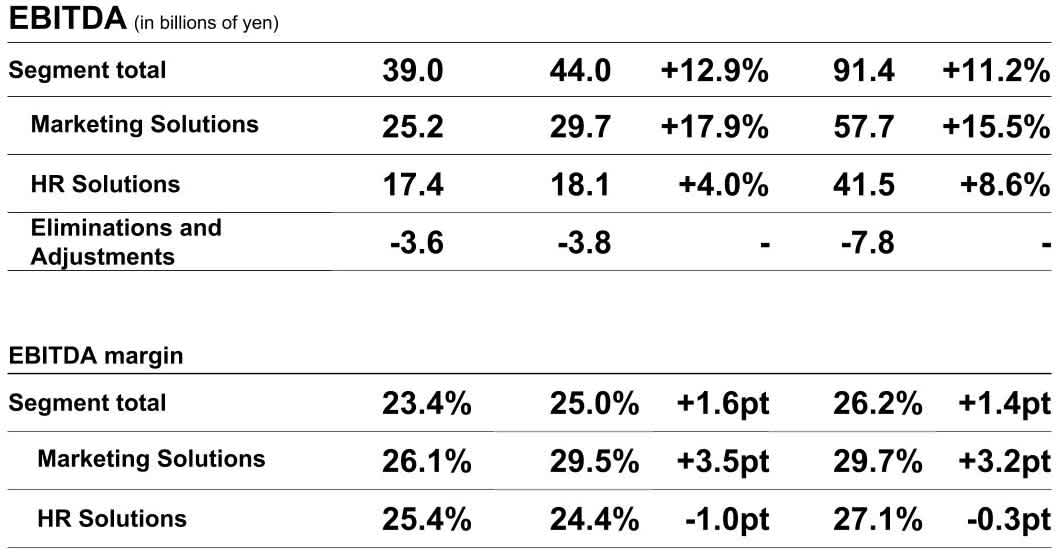

Media & Solutions

(1) The recruiting assessment business previously recorded in Recruiting in Japan was transferred into Others in HR Solutions, and the placement business for the medical industry previously recorded in Eliminations and Adjustments in Media & Solutions was transferred to Recruiting in Japan from Q1 FY2018. Excluding these one-time factors, revenue in Recruiting in Japan increased 7.3%.

In the Media & Solutions segment, revenue increased 5.5% year on year, EBITDA grew 12.9% and EBITDA margin was 25.0%. Excluding the impact of the change in the treatment of intra-group transactions, EBITDA increased 8.6%.

First, some of the highlights of the Marketing Solutions in Media & Solutions.

Revenue in the Beauty business, the fastest growing subsegment in Marketing Solutions, increased 13.3% year on year, due to an increase in the number of online beauty salon reservations made through the platform, as well as an increase in the number of beauty salon clients located in non-urban areas and the outskirts of metropolitan areas.

In the Dining business, restaurant operators continued to face a challenging environment, mainly due to the workforce shortage in Japan. In these conditions, the Dining business focused on strengthening relationships with clients by offering operational solutions such as Air Series, a cloud-based operational support package. In addition, advertising revenue increased gradually against the backdrop of a recovering trend in the dining industry. As a result, revenue in the Dining business increased 4.7% year on year.

Despite the negative effect of natural disasters that hit Japan during the second quarter, revenue in the Travel business increased 4.4% year on year, driven by an increase in both the number of hotel guests and the price per night of hotels booked through our online reservation platform.

In Housing and Real Estate, revenue in the independent housing and leasing divisions grew as a result of sales initiatives offering solutions to clients and efforts to attract more users to the platform. Meanwhile, overall subsegment revenue increased by 0.3% year on year, resulting from the sale of a subsidiary during the third quarter of FY2017. Excluding this one-time impact, revenue was up 7.6% year on year.

The Bridal subsegment focused on responding proactively to the needs of major wedding venue operators to attract marrying couples, despite a continued decline in the number of marriages in Japan mainly resulting from the declining population. As a result, quarterly revenue decreased 0.7% year on year.

Quarterly revenue in Marketing Solutions increased 4.1%, and quarterly EBITDA increased 17.9% year on year with an EBITDA margin of 29.5%. Excluding the impact of the change in the treatment of intra-group transactions, EBITDA increased 14.1%.

In HR Solutions, the Recruiting in Japan subsegment, particularly the professional recruiting businesses, saw strong performance supported by the continued favorable business environment in the Japanese labor market. As a result, quarterly revenue increased 8.2% year on year, quarterly EBITDA increased 4.0%, and EBITDA margin was 24.4%. Excluding the impact of the change in the treatment of intra-group transactions, EBITDA increased 1.8%.

Quarterly revenue in Recruiting in Japan of HR Solutions was affected by two one-time factors. The first factor had a negative impact on revenue due to the transfer of the recruiting assessment business from Recruiting in Japan to the Others subsegment beginning from the first quarter of FY2018. The second factor positively impacted revenue due to the transfer of the placement business for the medical industry to Recruiting in Japan from Eliminations and Adjustments in Media & Solutions. Revenue in Recruiting in Japan increased 6.7% year on year, but excluding these one-time factors, revenue increased 7.3%.

The Others subsegment in HR Solutions increased 23.0% due to the transfer of the recruiting assessment business to this subsegment.

Staffing

Staffing revenue in the second quarter was up 0.4% year on year. Quarterly EBITDA decreased 0.1%, and the EBITDA margin was 6.2%. Excluding the impact of the change in the treatment of intra-group transactions, quarterly EBITDA decreased 3.0%.

The Japanese staffing market continued to expand as evidenced by the

ongoing strong demand for agency workers while the number of active

agency workers remained elevated. In this environment, the Japanese

operations invested in advertisement to attract new potential agency

workers and also focused on extending existing staffing contracts. As a

result, quarterly revenue in the Japanese operations increased 7.0% year

on year, quarterly EBITDA increased 4.5%, and the EBITDA margin was

7.2%. Excluding the impact of the change in the treatment of intra-group

transactions, quarterly EBITDA decreased 2.0%.

Revenue and EBITDA

for the first half in FY2018 increased 7.4% and 12.0%, respectively.

Quarterly EBITDA growth was lower compared to the first quarter, mainly

due to the timing of investments in advertisement.

In the overseas operations, quarterly revenue decreased 3.7% year on year, EBITDA decreased 3.9% and the EBITDA margin was 5.5%. Quarterly revenue in overseas staffing was affected by two factors. First, the negative effect of foreign exchange rate movements on quarterly revenue was 3.2 billion yen. Second, the negative effect of the application of IFRS 15 on revenue was 4.0 billion yen--a portion of revenue from some subsidiaries was recognized on a net basis as opposed to a gross basis. Excluding these impacts, quarterly revenue was flat compared to the same period of the previous fiscal year.

Quarterly EBITDA in overseas operations decreased mainly due to an increased expense to simplify the operational governance model in Europe. We continuously focused on profitability based on the Unit Management System. EBITDA margin was 5.5%, remaining flat year on year. For the first half of FY2018, EBITDA increased 4.7%, and EBITDA margin was 5.5%.

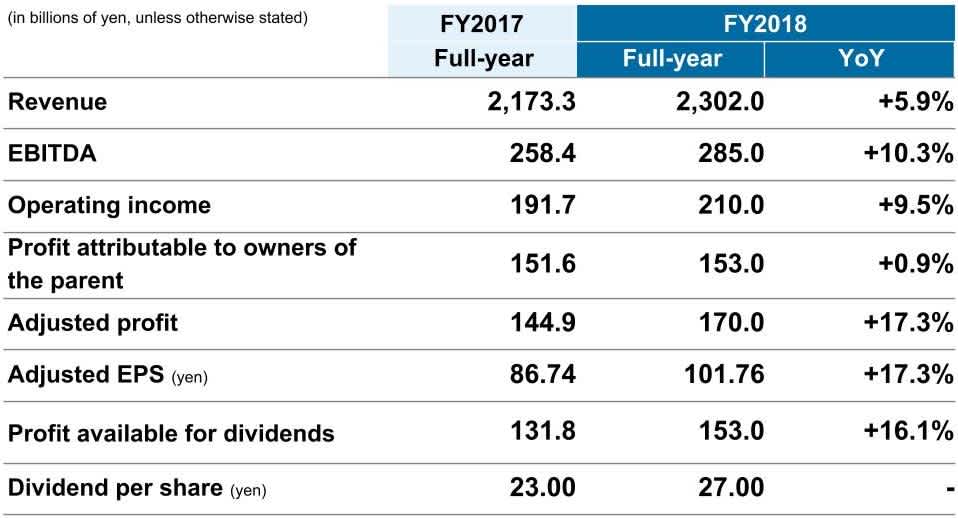

4.FY2018 Consolidated Financial Forecast

The FY2018 full year forecast has not changed since the announcement on May 15, 2018.

* Assumed foreign exchange rates for FY2018: 106 yen per US dollar, 131 yen per Euro, 84 yen per Australian dollar.

The book value of Glassdoor's assets and liabilities such as deferred revenue and deferred expense on the date of acquisition was adjusted to fair-value as part of the business combinations accounting process. As a result, we revised the forecast for the financial impact from Glassdoor for the nine-month period on the consolidated revenue and EBITDA for FY2018 to approximately 15.3 billion yen and -5.4 billion yen respectively from the original forecast of 18.2 billion yen and -3.5 billion yen which we reported on June 21, 2018.

The full-year forecast for FY2018 has not been changed since the announcement on May 15, 2018.

Also, Board of Directors has resolved on the payment of interim dividends of 13.5 yen per share on November 13, 2018.

5.FAQ's for Q2 FY2018

Financial Results for Q2 FY2018

Consolidated Results

Q1:

Why did the year-on-year growth rate of EBITDA increase from

9.5% in Q1 FY2018 to 13.6% in Q2 FY2018?

A1:

This is due to the higher growth rate in EBITDA for Media &

Solutions and HR technology compared to Q1 FY2018. HR Technology

contributed significantly to the EBITDA growth rate, with an increase of

69.9% in Q2 FY2018, compared to 21.6% in Q1 FY2018.

Q2:

Why was the year-on-year growth rate of adjusted profit

(27.4%) higher than that of profit attributable to owners of the parent

(8.3%) in Q2 FY2018?

A2:

There were two reasons for the higher growth rate of adjusted

profit compared to that of profit attributable to owners of the parent.

The first reason was the lower tax exemption amount in Q2 FY2018, which

led to higher growth rate in adjusted profit due to tax reconciliation

compared to the same period of the last fiscal year.

The second

reason was the change in the adjustment item included to calculate

adjusted profit.

Please refer to Q6 of FAQ's for Q1

FY2018:

https://recruit-holdings.com/en/newsroom/20180810_q1_fy2018_financial_results/

Please refer to the following definition of adjusted profit and adjustment items;

-

Adjusted profit = profit attributable to owners of the parent ± adjustment items* (excluding non-controlling interests) ± tax reconciliation related to certain adjustment items

*Adjustment items = amortization of intangible assets arising due to business combinations ± non-recurring income/losses

[reference: adjusted EPS assuming the change was applied in the previous years]

-

FY2016: 80.32 yen, an increase of 0.3% from 80.06 yen as disclosed.

-

FY2017: 88.61 yen, an increase of 2.2% from 86.74 yen as disclosed.

[reference: adjusted EPS in FY2018]

-

Q1 FY2018: 29.37 yen, an increase of 8.3% from 27.12 yen, adjusted for the same items as the previous quarters.

-

Q2 FY2018: 29.26 yen, an increase of 4.4% from 28.04 yen, adjusted for the same items as the previous quarters.

-

1st Half FY2018: 58.64 yen, an increase of 6.3% from 55.15 yen, adjusted for the same items as the previous quarters.

Q3:

How did the acquisition of Glassdoor impact the consolidated

balance sheet at the end of Q2 FY2018?

A3:

The completion of the acquisition of Glassdoor during Q1

FY2018 resulted in an increase in goodwill of 132.3 billion yen in the

consolidated financial statement as of the end of Q1 FY2018. Recruit

Holdings further evaluated the fair value based on the additional

information it obtained during Q2 FY2018 and the amount of goodwill was

changed to 98.3 billion yen tentatively at the end of Q2 FY2018. Recruit

Holdings plans to complete the allocation of consideration paid for

acquisition including the classification of goodwill based on the fair

value by the end of FY2018.

Q4:

How did foreign exchange rate movements impact consolidated

revenue?

A4:

The negative impact of foreign exchange rate movements on the

consolidated revenue for Q2 FY2018 was 2.9 billion yen. Foreign exchange

rate movements positively impacted revenue by 0.6 billion yen for the

first half of FY2018.

HR Technology

Q5:

Please provide details regarding the revision of Indeed's

results for Q1 FY2018 due to the adoption of IFRS 15. What impact will

be expected for the full-year financial results for FY2018?

A5:

Recruit Holdings changed the accounting policies from Q1

FY2018, adopting IFRS 15. As a result, it was concluded that sales

agents for some transactions should be defined as the customer, then

requiring that the transaction net amount (equal to the gross amount

less agency commissions earned) be recognized as

revenue.

Accordingly, Recruit Holdings revised revenue of the HR

Technology segment for Q1 FY2018 retrospectively, resulting in a

reduction of each of Indeed's revenue and cost of sales by the same

amount of 1.8 billion yen. Recruit Holdings has submitted the revision

to the consolidated financial results for Q1 FY2018.

Assuming IFRS

15 was applied in Q1 FY2017 on a pro forma basis, revenue of the HR

Technology segment for Q1 FY2018 on a US dollar basis would have

increased 57.6% year on year*.

Please refer to the following link

for further details on the revision of the results for Q1 FY2018

:

"(Revision / Revision of Numerical Data) Partial Revision to the

"Consolidated Financial Results for the Three Months Ended June 30, 2018

(IFRS, Unaudited)," released on November 13, 2018:

https://recruit-holdings.com/en/newsroom/20181113_03/

*These are the financial results of operating companies in the HR Technology segment, which differ from the consolidated financial results of Recruit Holdings Co., Ltd.

Q6:

Please explain the purchase accounting adjustments related to

Glassdoor and how the consolidated forecasts for Glassdoor will be

impacted?

A6:

In adjusting Glassdoor's assets and liabilities to fair

market value in the business combinations accounting process after the

acquisition of Glassdoor, a certain amount of revenue, which was

originally planned to be recorded in its profit and loss statement of

Recruit Holdings after Q2 FY2018, was recorded as a net asset in its

balance sheet. This one-off impact arises from the consolidation of

Glassdoor's assets and liabilities into the consolidated financial

statements, with a majority of the impact expected to be realized in the

current fiscal year. Further, this adjustment has no impact on

Glassdoor's cash flow as it arises from the fair market valuation of the

acquired assets and liabilities.

The expected financial impact from

the acquisition of Glassdoor on the consolidated revenue, EBITDA, and

adjusted profit for FY2018 has been updated to approximately 15.3

billion yen, -5.4 billion yen, and -4.4 billion yen, respectively. The

previously announced expected impact on the consolidated revenue,

EBITDA, and adjusted profit for FY2018 was 18.2 billion yen, -3.5

billion yen, and -3.5 billion yen, respectively.

Q7:

Why did quarterly revenue of the HR Technology segment on a

US dollar basis continue to grow strongly in Q2 FY2018? What was the

year on year growth rate assuming IFRS 15 is applied to the previous

fiscal year?

A7:

The strong revenue growth continued mainly due to increased

sponsored job advertising revenue from new and existing customers at

Indeed, against the backdrop of a favorable economic environment and

strong labor market. In addition, the inclusion of Glassdoor in the

consolidated results from July 2018 positively impacted the revenue

growth rate. As a result, revenue for Q2 and 1st half FY2018 on a US

dollar basis increased 55.1% and 53.5% year on year, respectively.

Assuming the change in accounting policies was applied in the previous

fiscal year on a pro forma basis, revenue increased 60.6% in Q2 and

59.2% in the 1st half FY2018 year on year, respectively.

Please

refer to Q5 for details regarding IFRS 15.

Q8:

Why did quarterly EBITDA increase 69.9% year on year in the

HR Technology segment? Why did EBITDA margin increase 1.4 points to

17.4% in Q2 FY2018, with higher growth rate than in Q2 FY 2017?

A8:

EBITDA growth was primarily a result of strong revenue

growth. In Q2 FY2018, Indeed gained scale in its sales, marketing and

customer support functions, while continuing to invest aggressively in

product and engineering to build enhanced functionality for job seekers

and employers. As a result, EBITDA margin increased by 1.4 points year

on year. The reassessed identification of a customer due to the IFRS 15

definition described in Q5 did not impact EBITDA, while negatively

impacting revenue. While EBITDA margin of the HR Technology segment will

fluctuate throughout the year depending on the timing of investments, it

is expected to remain within the target range of 10% to 20% on an

annualized basis.

Q9:

What was the difference in revenue growth rate between the US

and Non-US business of the HR Technology segment?

A9:

HR Technology continued to achieve strong revenue growth in

the US. Additionally, due to the earlier stages of the market

development, the revenue growth rate in non-US markets continued to

outpace the US, driven by strong performance in countries such as Japan,

UK, Canada and Germany. We do not disclose revenue by regions.

Q10:

How many unique visitors did Indeed reach? Please also

provide an update on the number of resumes, employees and

offices.

A10:

Indeed attracted approximately 250 million unique visitors

per month, achieving double digit growth year on year in Q2 FY2018.

Indeed's resume database grew year on year with over 120 million resumes

uploaded to its platform as of the end of September 2018. As of the end

of Q2 FY2018, Indeed had approximately 7,400 employees and 27 offices

globally in 14 countries.

Q11:

How many unique visitors did Glassdoor reach? Please also

provide an update on the number of employees and offices.

A11:

Glassdoor attracted approximately 60 million unique visitors

per month in Q2 FY2018, achieving double digit growth year on year. As

of the end of Q2 FY2018, Glassdoor had approximately 800 employees and 7

offices.

Media & Solutions

Q12:

Why did quarterly EBITDA in Marketing Solutions increase

17.9% year on year?

A12:

This was largely driven by increased EBITDA in the Beauty

subsegment within Marketing Solutions. In addition, there was a positive

impact on quarterly EBITDA because the treatment of intra-group

transactions such as management service fees and general administrative

fees was changed at the beginning in Q1 FY2018 due to the group

reorganization implemented from last year. Excluding the impact of the

change in the treatment of intra-group transactions, EBITDA increased

14.1% year on year.

Q13:

Why did quarterly revenue in the Housing and Real Estate

subsegment stay flat in Q2 FY2018 compared to a decrease in Q1

FY2018?

A13:

Recruit Forrent Insure Co., Ltd., was sold in October 2017,

resulting in a year on year decrease in revenue; quarterly revenue for

Q2 FY2018 increased due to the continued growth in the independent

housing division and leasing division. Excluding the one-time impact of

1.7 billion yen on quarterly revenue due to the sale of the subsidiary,

quarterly revenue increased 7.6% year on year.

Q14:

Why did quarterly revenue and EBITDA in HR Solutions

increase 8.2% and 4.0% year on year, respectively?

A14:

Revenue increased in Recruiting in Japan as a result of

solid performance in the professional recruiting business. In addition,

quarterly revenue and EBITDA increased due to the transfer of the

placement business for the medical industry to the Recruiting in Japan

subsegment from Eliminations and Adjustments in the Media & Solutions

segment. Excluding the impact of the change in intra-group transactions

described in Q12, quarterly EBITDA increased 1.8% year on

year.

Quarterly EBITDA growth rate was lower than revenue growth

rate for Q2 FY2018, mainly due to an increased investments in

advertising and in the sales force to strengthen our

competitiveness.

Q15:

Why did quarterly revenue in the Others subsegment in HR

Solutions increase 23.0% year on year? What is the reason for slower

revenue growth rate compared to Q1?

A15:

Revenue increased mainly due to the transfer of the

recruiting assessment business from the Recruiting in Japan subsegment

to the Others subsegment in HR Solutions from Q1 FY2018. The recruiting

assessment business has a seasonality in revenue trend. The revenue

tends to be higher in Q1, during which many companies conduct recruiting

assessments in their recruiting and hiring process. As a result, the

revenue growth rate for Q2 FY2018 was lower than that for Q1

FY2018.

Staffing

Q16:

Why did quarterly revenue in Japan operations in Staffing

increase 7.0% year on year?

A16:

In the Japanese labor market, the number of active agency

workers remained at a high level and the demand for agency workers

continued to be strong. In this environment, Japan operations focused on

increasing the number of its registered agency workers and new staffing

contracts, as well as extending existing staffing contracts. As a

result, quarterly revenue increased year on year.

Q17:

Why did quarterly EBITDA in Japan operations in Staffing

decrease compared to that for Q1?

A17:

EBITDA decreased due to an increased investment mainly in

advertisement to attract more potential agency workers in order to

maintain revenue growth. The timing of these marketing investments was

concentrated in this quarter.

Further, Japan operations in the

Staffing segment were affected by the change in the treatment of

intra-group transactions which also impacted the Media & Solutions

segment. Excluding the impact of the change in the intra-group

transactions, EBITDA decreased 2.0% year on year.

Q18:

Why did quarterly revenue in overseas operations in Staffing

decrease 3.7% year on year?

A18:

Revenue decreased due to the negative impact of foreign

exchange rate movements of 3.2 billion and the adoption of IFRS 15 on

quarterly revenue of 4.0 billion. Excluding these impacts, the quarterly

revenue was flat year on year.

Q19:

Why did quarterly EBITDA growth in overseas operations in

the Staffing segment decrease to -3.9%, compared to an increase of 15.0%

in Q1 FY2018?

A19:

EBITDA was negatively impacted mainly by an increase in

investments to simplify the operational governance model in Europe to

improve future productivity. Overseas operations continued to focus on

the implementation of the Unit Management System to increase

profitability.

6. Video

7. Results Materials

Latest

Investors' Kit for Q2 FY2018(1.3 MB)(ZIP)

Earnings

Release for Q2 FY2018 (717 KB)

Presentation

Material for Q2 FY2018

Supplemental

Financial Data for Q2 FY2018(370 KB)(Excel)

Disclaimer

In preparing these materials, Recruit Holdings Co., Ltd.

relies upon and assumes the accuracy and completeness of all available

information. However, we make no representations or warranties of any kind,

express or implied, about the completeness and accuracy. This presentation

also contains forward-looking statements. Actual results, performance and

achievements are subject to various risks and uncertainties. Accordingly,

actual results may differ significantly from those expressed or implied by

forward-looking statements. Readers are cautioned against placing undue

reliance on forward-looking statements.

Third parties are not permitted

to use and/or disclose this document and the contents herein for any other

purpose without the prior written consent of Recruit Holdings Co.,

Ltd.